AtlasFive® Capabilities

Achieve More with AtlasFive®, the Next-Generation Wealth Management Software, Enhanced by EtonAI™ (previously EtonGPT™)

By harnessing cloud native artificial intelligence technologies, best-in-class cybersecurity and advanced data governance – coupled with unmatched domain expertise, Eton Solutions is helping wealth management firms evolve to a Hybrid AI-HumAIn™ Delivery Framework. Our cloud-native platform, AtlasFive®, has established the benchmark for industry best practices of Wealth Management that goes beyond traditional data aggregation and reporting capabilities.

AtlasFive® is the most advanced wealth management platform integrating entity management, portfolio management, GL and fund accounting, transaction processing, document management and more into a unified digital ecosystem. The platform is trusted by Single Family Offices, Multi Family Offices, Wealth Owners, RIAs, Business Managers, Private Equity globally, managing over $1.3 trillion in assets.

Single Source of Truth

Eton Solutions simplifies your wealth management operations by unifying your investment, accounting, and tax data into one integrated system.

Say goodbye to the frustration of reconciling data across multiple tools. Our platform provides a consistent and reliable source of truth, ensuring seamless access to data for smarter decision-making. As the only fully integrated AI solution for wealth management, we lay the foundation for AI-powered insights, helping you unlock the full potential of your data.

Your Complexity is Our Simplicity

At Eton Solutions, we thrive on simplifying the complexities of wealth management for our diverse clients, including Single Family Offices, Multi Family Offices, Business Managers, Wealth Owners, Registered Investment Advisors, Private Equity and Partners. No matter how complex your operations are – whether you’re managing multi-generational families or private equity firms requiring look-through capabilities on underlying investments, our platform turns complexity into streamlined efficiency.

AtlasFive® combines cutting-edge AI with advanced data integration to manage 270+ workflows across investment management, accounting, tax, document management, bill pay, transaction processing fund accounting, trust accounting and more. Our mission is simple: turning your challenges into seamless solutions, so you can achieve your goals with clarity and confidence, no matter how complex your needs.

Key Features of AtlasFive®

Streamline your family office operations with the best-in-class AtlasFive® integrated platform for improved efficiency.

Core Accounting

Integrated General Ledger, Trust, Partnership Accounting, and Tax Ledger

Real-time integrated General Ledger for streamlined operations.

- Flexible Chart of Accounts, Reporting Structures and unlimited Financial Statement Groupings: Customize your financial framework with adaptable account structures and create as many financial statement groupings as your business requires.

- Automated data feed processing and journal entry creation: Automatically process data feeds and generate journal entries, reducing manual work and ensuring accuracy.

- Automated Daily Bank and Book reconciliation: Maintain up-to-date and accurate records with daily automated reconciliation of your bank and book balances.

- Flexible Financial Statement reports at summary and detail levels with transaction level drill down features: Generate financial statements at both summary and detailed levels, with the ability to drill down into individual transactions.

- Experience smoother Period Close with AI-powered AtlasLens: Reduce the effort and time required to close the books with the assistance of AtlasLens’s artificial intelligence capabilities.

AtlasFive® is the only wealth management platform that seamlessly combines Trust Accounting with all your other office functions.

- All Trust Information in One Place: Maintain a centralized, structured repository for every trust-related detail—beneficiaries, grantors, trustees, trust types, and more. Everything is interconnected and easily accessible within your AtlasFive® environment.

- Automated Principal & Income Tracking: AtlasFive® automatically segregates and tracks Principal and Income, ensuring accuracy in distributions and accounting. Trigger income distributions and calculate trust fees directly from the system—no spreadsheets required.

- Purpose-Built Trust Reporting: Generate reports such as the Statement of Income, Statement of Assets, and Principal & Income Activity in just a few clicks. No customization needed—they’re built to meet fiduciary and regulatory standards from day one.

- Stay Compliant with Confidence: With the Automated Annual Account Review, AtlasFive® ensures all trust activity is regularly reviewed and documented—helping you meet your fiduciary responsibilities with ease and transparency.

Fully-integrated, automated module for managing all your Partnership Accounting needs

- Adaptable across diverse fund types: Works seamlessly with Hedge Funds, Private Equity, Real Estate, Multi Tranche, Funds with Side Pockets, Money Market Style, and Hybrid funds.

- Automated allocation of Net Income and Distribution Calculation (Pro Rata to Waterfall Method): Effortlessly handle complex allocations, track Capital Commitments, Distributions, NAV, Units, Price, MOIC, IRR, and more—all within a single, user-friendly interface.

- Partnership Book of Records seamlessly reconciles with your General Ledger and Investment Book of Records: Eliminate discrepancies with fully integrated reconciliation between books.

- EtonAI™ supports extraction of data from Capital Call Notices, Distribution Notices, Manager Statements, etc: Automate workflows for transaction processing and mark-to-market with advanced data extraction.

Obtain the needed information to support meeting your tax reporting requirements.

- Automated tax classification and reporting of all income and expenses by tax categories: Easily track tax details by relationships, entities, accounts, securities, and funds, ensuring full visibility and accuracy.

- Utilize the Tax Ledger as workpapers for Estimated Tax Filing: Prepare and organize your estimated tax filings with structured, audit-ready workpapers.

- All tax related documents like Tax Return, Contributions, etc. are segregated out by type, year or any other specifics for quick reference: Quickly locate and reference all your tax documents, organized for maximum efficiency.

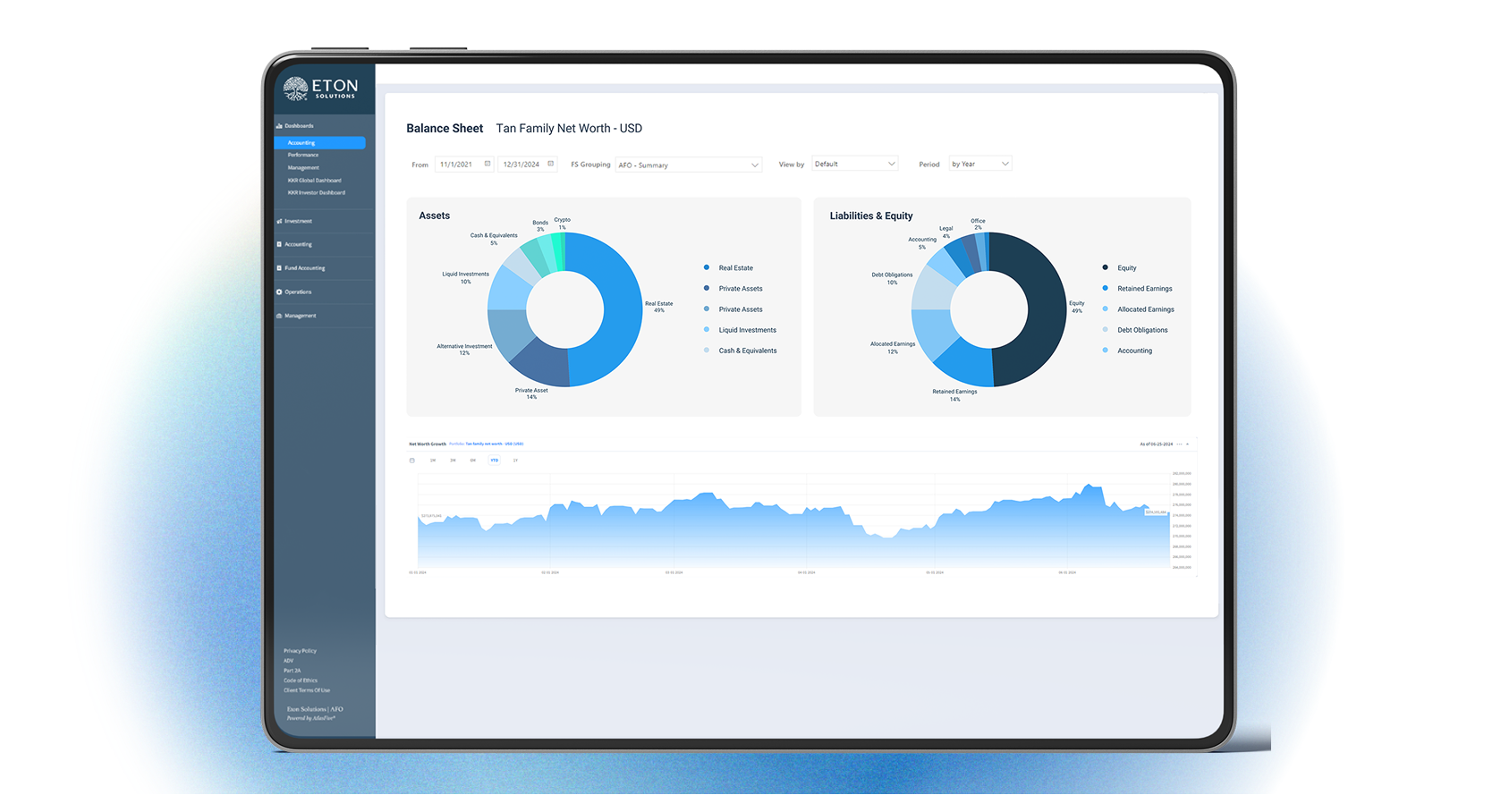

Portfolio Management and Performance Reporting

Institutional-Grade Oversight with Personalized Precision: AtlasFive® empowers wealth managers and family offices to manage investment portfolios with the same rigor as institutional investors—while remaining flexible to the unique needs of UHNW clients.

- Establish Strategy and Track Outcomes: Define investment objectives, set custom benchmarks, and track portfolio targets versus actuals in real time. Create simultaneous multi-currency portfolio views tailored for clients, advisors, and auditors alike.

- Cash and Allocation Controls: Assign minimum and maximum cash thresholds, configure passive vs. active preferences, and set income targets to align portfolio construction with each family’s liquidity, yield, and growth goals.

From Complexity to Clarity: Convert raw portfolio data into actionable insights with rich analytics, dynamic visualizations, and investor-grade reporting—powered by AtlasFive® and EtonAI™.

- Unified Net Worth and P&L Views: Understand wealth at a glance, across all entities and accounts, including Look-Through reporting into underlying investments and roll-up across family members or structures.

- Daily Performance Dashboards: Instantly analyze investment performance across portfolios, asset classes, geographies, sectors, and more. Drill into outliers, performance trends, or concentration risks in just a few clicks.

- AI-Powered Insights with EtonAI™: Automatically analyze allocation vs. targets, flag top or underperforming assets, and simulate what-if scenarios for rebalancing, cash needs, or market shifts using natural language prompts.

Proactive Risk Governance: Go beyond traditional reporting with AI-driven risk analysis and automated compliance workflows.

- Ongoing Risk Monitoring: Conduct Automated Annual Investment Account Reviews using structured, repeatable workflows that validate both financial and non-financial data.

- Exception Management: Automatically flag restricted holdings, concentration limits, or anomalies that require immediate attention—keeping your portfolios aligned with both mandate and regulation.

- AI-Enhanced Research & Evaluation: With EtonAI™, assess security-level risks, compare financial statements, conduct market research, and evaluate investment fund documents against custom risk checklists.

A Complete Picture of Wealth—Across Every Asset Class: AtlasFive® consolidates all financial and personal assets into one centralized view to support holistic wealth planning and management.

- Marketable Assets: Equities, Bonds, Fixed Income, Cash, T-Bills, ETFs, Mutual Funds.

- Alternatives: Hedge Funds, Fund of Funds, Private Equity, Real Estate, Venture Capital.

- Other Illiquid Assets: Insurance policies, Business Interests, Art, Jewelry, Collectibles.

- Personal Assets: Homes, Cars, Aircrafts, Yachts—tracked with precision and included in total net worth calculations.

Efficiently create and manage loans with full visibility and control.

- Intra-Entity and External Loan Tracking: Manage both internal and external loans with comprehensive data storage for each loan.

- Centralized Data Points: Store detailed loan information in one place, enhancing accuracy and accessibility.

- Efficient Transaction Updates: Post transactions that automatically update both lender and borrower records, reducing manual effort and increasing workflow efficiency.

Document Management

Harness AI to transform document handling from passive storage into intelligent, real-time automation.

Role- and type-based permissions ensures precise control over who can view, edit, or manage documents across the platform. A comprehensive digital audit trail automatically logs every action—upload, download, modification, access—ensuring full transparency and regulatory compliance.

Including CRM, transaction processing, annual account reviews, client reporting and more – document handling becomes a native part of daily workflows—not an afterthought.

EtonAIgency™ (patent pending web agent) automatically logs into secure portals, bypassing MFA, captchas, and token walls to fetch your files for you—no human effort required.

No more manual document tagging. EtonAI™ extracts key data (amounts, dates, entities, funds, payment amounts and more) from 250+ document types like invoices, capital calls, bank/manager statements, K-1s, and KYC forms—instantly and accurately. Every document is auto-tagged, indexed, and classified. No sorting. No naming files. No folder hunting.

All documents are instantly searchable in natural language and summarized, turning unstructured content into actionable intelligence.

Entity Management

See everything. Control everything. All in one place. AtlasFive®’s Entity Management unifies your entire wealth network—clients, entities, ownerships, portfolios, accounts, and relationships—into a single, intelligent platform.

Track every family office, trust, LLC, partnership, or holding company with detailed profiles and real-time connections. Get a complete picture of each entity or person: contact info, accounts, documents, activities, and linked relationships—all centralized and up to date.

With AtlasFive®, your financial reporting becomes streamlined and unified across global entities. The Global Chart of Accounts simplifies consolidation and tracking of financial performance, enabling clear, consistent reporting regardless of geographical or jurisdictional differences.

Tailor the system to your family office’s specific requirements by creating customizable fields and data models. This flexibility ensures that AtlasFive® adapts to your way of working—not the other way around—empowering your team to focus on value-driven tasks, not manual configurations.

Cash Management

Simplify your payment lifecycle while maintaining control and compliance across vendors, custodians, and banks.

- Integrated Payments Gateway: Initiate payment instructions directly from AtlasFive® to custodians, banks, funds, and vendors with full support for Check Printing, Same Day and Standard ACH, Domestic and International Wires, Account-to-Account Transfers, and Positive Pay transactions.

- BILL Integration: Effortlessly pay vendors using accounts at any U.S. bank through our integration with BILL, minimizing friction and increasing flexibility in treasury operations.

- AI-Powered Invoice Automation: EtonAI™ automatically extract data from invoices and bills creating workflows in AtlasFive’s®—cutting manual effort, reducing human error, and accelerating approval workflows.

Increase operational efficiency with AI-enhanced workflows that automate transaction recognition and execution.

- Automated Data Extraction from 250+ Financial Document Types: EtonAI™ extracts data from Capital Call Notices, Distribution Notices, Manager Statements, and more, creating workflows for seamless transaction processing and mark-to-market updates in AtlasFive®.

- Contextual OCR with Embedded Intelligence

Our patent-pending Contextual OCR leverages machine learning, EtonAI™, AtlasFive® CRM Knowledge Graph, and Memorized Transactions to auto-identify critical information from document images—no manual training required. - Smart Transaction Tagging and Payment Execution

Tag documents to transactions, entities or accounts and initiate capital call payments directly from AtlasFive®, ensuring end-to-end automation and traceability within your financial ecosystem.

Plan ahead with precision. AtlasFive® empowers you to forecast and model liquidity with confidence.

- Flexible Modeling of Complex Cash Flows: Model recurring and one-time cash flows tailored to specific entities—such as quarterly contributions or event-based disbursements—ensuring more accurate liquidity planning.

- Entity-Level Scheduling: Define varying contribution and withdrawal schedules across entities, enabling granular control over short-term and long-term cash positioning.

- Exportable, Customizable Reporting: Generate reports of forecasted transactions for integration into custom reports or analytics dashboards, giving you full transparency and control over projected cash movements.

Client Reporting: Instant, Tailored Insights

- Pre-Built Reports: Access 50+ ready-to-use reports across Investment, GL, Compliance, and more, including Daily Performance and Accounting Dashboards.

- Custom Dashboards: Use AtlasFive® Reporting APIs to create your own tailored reporting solutions.

- Power BI Integration: Easily explore and break down AtlasFive® data with Power BI tools.

- Natural Language Analysis: Leverage EtonAI™ to analyze reports, generate insights, and translate them into multiple languages.

Data Integration

- Access to +1,500 banks and custodians directly or through our partner aggregators.

- Daily automated data feed processing and aggregation with an AI based Business Rule Engine.

- Documents processed include brokerage statements, manager statements, invoices, capital call notices, distribution notices, tax forms, etc. You can also leverage our patent pending Contextual OCR technology to extract data from these documents.

- Eton Solutions Services Team helps with statement processing and portal data extraction, including historical data migration.

Workflows & Audit Trail

- Tailored Workflows: Build custom task paths that match your office’s operations—from approvals to transactions—ensuring nothing falls through the cracks.

- Smart Access Control: Grant the right people access to the right assets, reports, and documents—protecting sensitive data by design.

- Complete Audit Trail: Every click, login, edit, or download is tracked—giving you a full, secure record for compliance and peace of mind.

Artificial Intelligence

EtonAI™ (previously EtonGPT™) leverages a powerful combination of best-in-class AI technologies to optimize processes and improve efficiency effectively.

Digitize and Automate the Paper Trail: EtonAI™ eliminates manual data entry and document chaos with intelligent automation across 250+ document types—delivering speed, accuracy, and compliance.

- Instant Data Extraction Across All Document Types: From invoices and capital calls to K-1s, bank/manager statements, and KYC forms—EtonAI™ extracts key information (dates, amounts, entities, funds, etc.) with precision, using advanced OCR, Large Language Models (LLMs), and contextual enrichment.

- Effortless Document Collection via EtonAIgency™ (Patent Pending): Automatically fetches documents from secure web portals—bypassing captchas, MFA, and login walls—so your team doesn’t have to. No emails, no downloads, no logins—just data at your fingertips.

- Organized, Classified, and Indexed—Automatically: Every document is sorted, tagged, and filed without human input. There’s no need to rename files or organize folders—AI handles it all, instantly.

- Understands Context, Not Just Text: With OCR + LLMs + the ICL Knowledge Graph (Patent Pending), EtonAI™ understands relationships between accounts, transactions, and entities—improving extraction accuracy, reducing rework, and enhancing audit-readiness.

- From Document to Workflow—In Seconds: Trigger downstream actions directly from documents. Invoices initiate bill pay. Capital calls move cash. Valuations update mark-to-market. All driven by a customizable Business Rule Engine.

Turn Natural Language into Portfolio Intelligence: EtonAI™ Portal transforms how teams access, query, and act on private data—no technical skills required.

- Conversational Front-End for Private Data: Ask questions like “Show me top performing funds by IRR” or “Summarize last quarter’s capital calls”. EtonAI™ interprets natural language and delivers direct answers from your private AtlasFive® instance.

- Semantic Document Search: Our Vector Database chunks, embeds, and indexes hundreds of thousands of documents—enabling fast semantic search and retrieval, without any size constraints.

- Upload, Analyze, Summarize—Any File Type: Upload PDFs, images, spreadsheets,. EtonAI™ converts everything into structured text and provides summaries, translations, or extractions in seconds.

- Built-in Web Research for Market Insights: Access real-time insights and external financial data securely—without switching tabs or using external tools. Ideal for investment research and manager monitoring.

- Multi-Language and Multi-Modal Intelligence: Translate reports, summarize foreign-language documents, redact and narrate sensitive files, or convert infographics into actionable data—automatically.

- Dynamic Visualizations, Instantly Generated: Visualize investment trends, family ownership structures, or portfolio performance as exportable bar charts, scatter plots, family trees, or Excel reports—powered by Eton’s Patent-Pending Dynamic Visualization.

- Power BI + AutoML for Deeper Analysis: Slice and dice reports using Power BI’s AutoML, directly through the portal. Empower non-technical teams to explore, detect patterns, and gain new insights without coding.

Trust Built Into Every Interaction: EtonAI™ is designed with responsibility at its core—ensuring your data is protected, decisions are explainable, and ethical boundaries are never crossed.

- Secure AI Infrastructure with Private GPT: EtonAI™ runs in a dedicated, private instance—meaning your data is never shared, never exposed, and never used to train public models. Your sensitive client and investment information stays inside your AtlasFive® environment, always.

- ISO 42001 Certified for Artificial Intelligence Management System: Eton is proud to be one of the first wealth platforms globally to achieve ISO/IEC 42001 certification — the international standard for AI Management Systems. This achievement reflects our deep commitment to the ethical and responsible use of AI, helping us build and maintain trust with our clients and stakeholders. It ensures alignment with evolving regulatory and legal requirements, effective management of AI-related risks, and fosters innovation within a structured and accountable governance framework. At Eton, AI isn’t just smart — it’s secure, transparent, and trustworthy.

- Explainable AI You Can Trust: EtonAI™ delivers not just answers, but reasoning. With Causal and Explainable AI frameworks, every prediction or suggestion is backed by traceable logic—giving users and compliance teams the visibility they need to trust automated insights.

- Prompt Logging for Auditability: Every prompt, every interaction with EtonAI™ is logged. This enables full traceability and accountability, so you always know how, why, and when a decision was made—supporting audits, internal reviews, and compliance reporting.

- No Hallucinations, Just Facts: With a hybrid architecture that combines real-time data, documents, and structured records, EtonAI™ minimizes the risk of hallucinated answers—ensuring decisions are grounded in verified truth, not guesswork.

EtonAI™ brings together the most advanced AI building blocks in the world, tailored specifically for the needs of Family Offices, Investment Advisors, and Wealth Institutions.

- Private, Cloud-Native AI Infrastructure: Security meets scalability. EtonAI™ runs on a dedicated, cloud-native infrastructure that is fully serverless, encrypted, and isolated. Your AI workloads are handled securely—completely separated from any public AI traffic.

- Hybrid Large Language Models (LLMs): Eton combines enterprise LLMs to deliver the perfect blend of intelligence, performance, and cost-efficiency. This multi-model strategy ensures optimal results for diverse tasks like extraction, summarization or market research—every time.

- Retrieval Augmented Generation (RAG): Go beyond static models. EtonAI™ uses RAG architecture to ground AI responses in your actual AtlasFive® data and documents. This ensures accurate, real-time answers based on what’s true—not what’s likely.

- Vector Database: With our vector database, documents are chunked, indexed, and vectorized, enabling semantic search across AtlasFive® document repository.

- ICL Knowledge Graph (Patent Pending): Eton’s ICL Knowledge Graph uncovers hidden connections between entities, accounts, and transactions, delivering unparalleled accuracy in data extraction and contextual understanding. It’s not just reading—it’s reasoning.

- Advanced Optical Character Recognition (OCR): From scanned capital calls to handwritten notes, EtonAI™ sees it all. Our OCR pipeline, enhanced by LLM-powered pre-processing, ensures high-precision data extraction—even from unstructured or low-quality files. (Patent Pending)

- Business Rule Engine (BRE): With 450+ family office-specific rules, our BRE automates processes like mark-to-market updates, position recon, transaction validation, and more, ensuring operational integrity at scale.

Cybersecurity and Privacy

Eton Solutions provided the best-in-class infrastructure for the Wealth Management sector, incorporating AI-driven threat intelligence.

- Continuous Monitoring: Security Operations Center (SOC) performs real-time infrastructure and data flow monitoring.

- Immediate Incident Response: Alerts and responds instantly to anomalies, breaches, or intrusion attempts.

- Isolated Deployment: Clients operate on isolated Azure single-tenant instances with optional customer-managed encryption keys (BYOK).

- Data Encryption: Data and documents encrypted at rest and in transit with AES-256 and TLS protocols.

- Access Controls: Role-based and entity-level access restricts user permissions, ensuring operational separation.

- Resilient Architecture: Cloud-native design with automated backups, immutable storage, and geographically redundant failover.

- Certifications & Compliance: Certified for ISO 42001 (Artificial Intelligence), ISO 27001 (Information Security), ISO 27701 (Privacy), SOC 1 Type II & SOC 2 Type II (System and Organization Controls), and compliant with GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act).

- Private LLMs: AI operates on private large language models without external data sharing.

- Explainable AI Outputs: AI results are traceable, explainable, and scoped to user-level data access, consistent with ISO 42001 principles.

- Single Sign-On (SSO): Secure user authentication simplifying access management.

- Multi-Factor Authentication (MFA): Enhanced security with additional authentication layers, aligned with enterprise standards.

Cloud Native

AtlasFive® is purpose-built on a cloud-native, serverless architecture that transforms the economics and agility of wealth management operations—delivering resilience, speed, and scale with zero infrastructure burden.

- Serverless Design: Purpose-built cloud-native architecture delivers resilience, speed, and scale with zero infrastructure burden.

- Maintenance-Free: No servers to maintain, no hardware refreshes, and no database tuning required.

- Focus Shift: Frees teams from low-value system upkeep to concentrate on client service and strategic growth.

- Pay-As-You-Go: Only pay for what you use, eliminating idle infrastructure costs and aligning spend with actual demand.

- Scalable Performance: Automatically scales compute power and storage during critical financial events like month-end reporting or market volatility.

- No Downtime: Scaling happens without manual intervention or system downtime.

- Invisible Updates: Continuous cloud-delivered updates and security patches run in the background, ensuring compliance and security without IT disruptions.

- Resilient Infrastructure: Geographically distributed, redundant systems guarantee uninterrupted availability.

- Disaster Recovery: Designed to maintain operations even during outages or natural disasters.

Business Continuity

AtlasFive® ensures that your wealth management operations remain uninterrupted. With industry-leading disaster recovery and backup strategies, your firm’s data is protected, always accessible, and always online.

AtlasFive® performs incremental backups every five minutes, combined with a full daily backup. This ensures that even during unexpected outages, your most recent data remains secure, minimizing disruption to client services and portfolio management.

AtlasFive® is hosted across multiple data centers worldwide, with “hot-hot” replication of your entire instance. This means that if one location fails, your backup server is immediately ready to take over with zero downtime—ensuring business continuity and client trust.

With a globally distributed cloud infrastructure, AtlasFive® ensures that your operations stay up and running, regardless of geographical challenges, natural disasters, or cyber threats. There’s no ‘down time’—your wealth management business is always operational.

An Implementation Process that is tailored for your needs

Unlike other so-called “integrated platforms” in the marketplace, we built AtlasFive® with the sole purpose of solving the challenges wealth management firms face every day.

Our founders and leadership built their careers in the wealth management industry. Our team’s deep industry experience means every workflow and data structure aligns with real-world practices, so you migrate from your existing systems seamlessly to AtlasFive® and start delivering value from day one.

Choosing AtlasFive® means gaining a partner invested in your success—beyond go-live. Our Global Service Center offers hands-on training, responsive troubleshooting, and proactive guidance so your team masters the platform quickly, maximizing productivity and minimizing disruption. With dedicated experts available around the clock, you’ll see faster adoption, higher ROI, and ongoing improvements tailored to your evolving needs.

Process mapping enabled by domain expertise.

We have lived your problems, mapped the diverse needs of family offices, designed our system around these needs through domain expertise, and can handle complex entity structures and transactions.