Data Aggregation for reporting, planning, and performance tracking is one of the most essential requirements for any family office. Its importance continues to grow. As the hub for a wide range of information critical to the family or families it serves, the family office needs to quickly and accurately aggregate, analyze, and report on data from various sources.

In the U.S., receiving daily electronic data feeds from custodians and banks is standard practice in 2021, even down to credit card spending and loans. One major growth area of “data” in the family office pertains to alternative investments, private equity, and direct investments. However, these investment data streams coming into the office tend to be unstructured and not in an electronic format.

A vexing challenge for the family office is that much of this data arrives through disparate technologies and siloed software applications, forcing the office to use spreadsheets to aggregate the data before attempting to derive meaning and insights. Making matters even more complex, the trajectory of all this data is on the rise, as is its importance to the family and impact on the work of the family office.

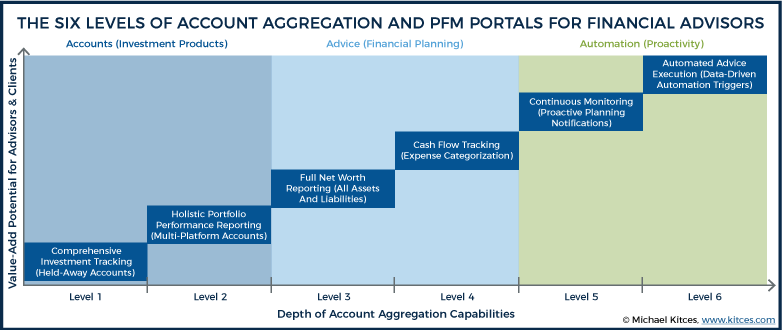

A couple of years ago, Michael Kitces, a well-known financial planning commentator, summarized the importance of data aggregation to the future of wealth management. His points are also valid for the family office.

This simple graphic summarizes a maturity model for data aggregation, along with the added value that can be achieved in each stage. It also demonstrates the importance of having the data needed for effective decision-making available in one place and normalized so that it is relational and bound by a data model that reflects the world of the family office.

Unfortunately, most wealth managers and family offices are only at Level 2 of this maturity model. Those forward-thinking family offices using a fully integrated technology platform, like AtlasFive, are at Level 4. They have the advantage of a single, unified data source, where both structured and unstructured data can be stored, queried, and reported on. This is a prerequisite for achieving Levels 5 and 6 in this diagram.

At these higher levels, the tools of Natural Language Generation (NLG), Artificial Intelligence (AI), and robotic data tools can be used to tremendous benefit. The goal of NLG, BOTS, or AI isn’t to replace employees. Instead, they enhance work tasks and allow staff members to add value where it really matters. They enable business processes to run with minimal (or no) effort from the team—to handle tasks automatically, send alerts, and trigger processes. The potential is there for these technologies to support and enhance businesses like a family office.

As the diagram indicates, mastering data aggregation will allow the family office to look forward. It means the office will finally have the data and tools to be proactive, to anticipate and service its family at a much higher level. This is when data aggregation has been reimagined at its highest level and when it can have the most significant impact on decision-making. It will be a key aspect of the family office of the future.