Capacités d'AtlasFive

Obtenez plus avec AtlasFive®, le logiciel de gestion de patrimoine de nouvelle génération, amélioré par EtonAI™ (anciennement EtonGPT™).

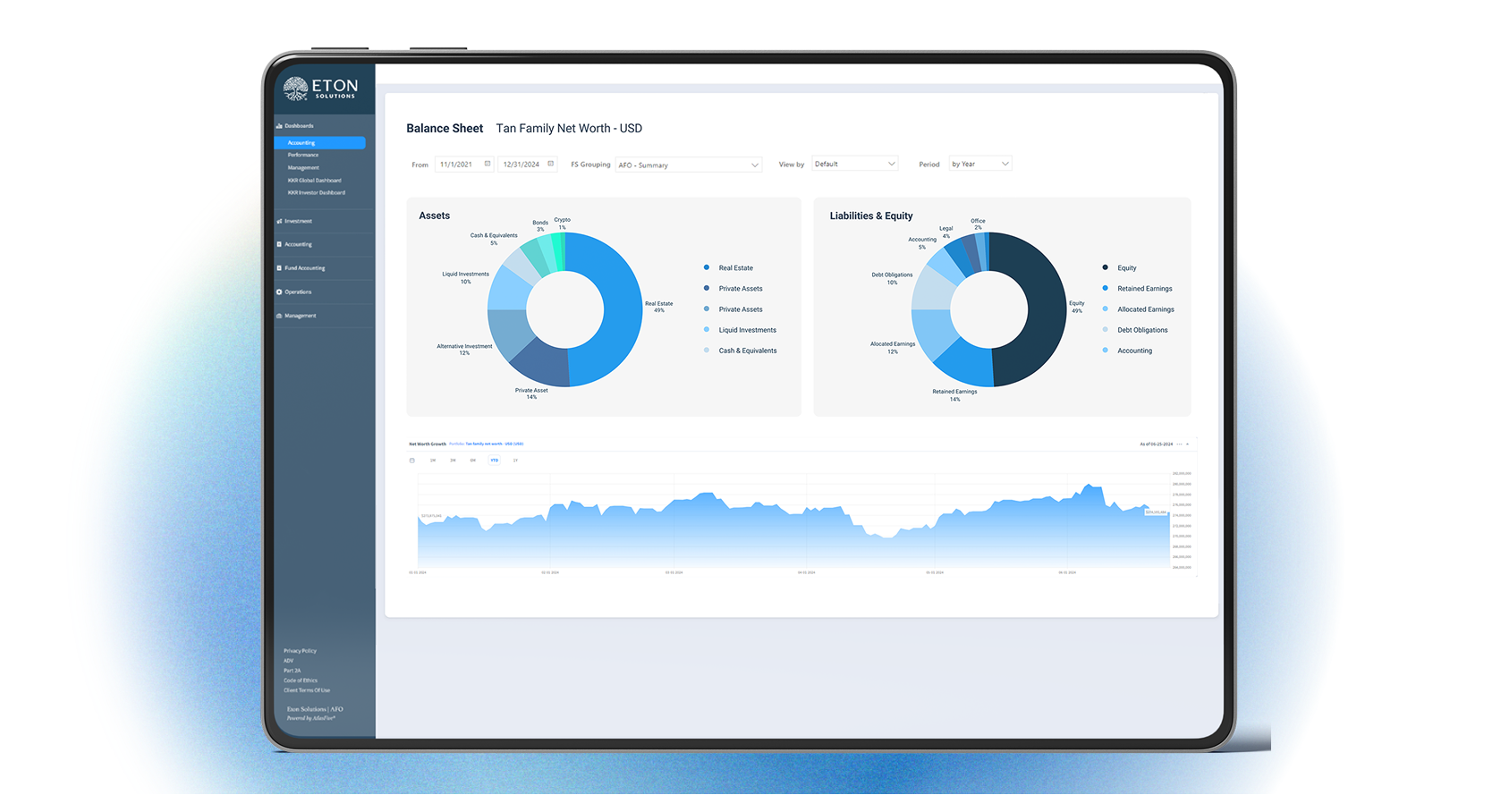

En exploitant les technologies d'intelligence artificielle natives du cloud, la meilleure cybersécurité de sa catégorie et une gouvernance des données avancée - associées à une expertise inégalée dans le domaine, Eton Solutions aide les sociétés de gestion de patrimoine à évoluer vers un cadre de prestation hybride AI-HumAIn™. Notre plateforme cloud-native, AtlasFive®, a établi la référence pour les meilleures pratiques de l'industrie de la gestion de patrimoine qui va au-delà des capacités traditionnelles d'agrégation de données et de reporting.

AtlasFive® est la plateforme de gestion de patrimoine la plus avancée, intégrant la gestion des entités, la gestion des portefeuilles, la comptabilité générale et la comptabilité des fonds, le traitement des transactions, la gestion des documents et plus encore, dans un écosystème numérique unifié. La plateforme est reconnue par les Single Family Offices, Multi Family Offices, Wealth Owners, RIAs, Business Managers, Private Equity dans le monde entier, gérant plus de $936 milliards d'actifs.

Une seule source de vérité

Eton Solutions simplifie vos opérations de gestion de patrimoine en unifiant vos données d'investissement, de comptabilité et de fiscalité en un seul système intégré.

Dites adieu à la frustration liée à la réconciliation des données entre plusieurs outils. Notre plateforme fournit une source de vérité cohérente et fiable, garantissant un accès transparent aux données pour une prise de décision plus intelligente. En tant que seule solution d'IA entièrement intégrée pour la gestion de patrimoine, nous posons les bases d'une connaissance alimentée par l'IA, en vous aidant à libérer tout le potentiel de vos données.

Votre complexité est notre simplicité

Chez Eton Solutions, nous nous efforçons de simplifier les complexités de la gestion de patrimoine pour nos divers clients, y compris les bureaux familiaux uniques, les bureaux familiaux multiples, les gestionnaires d'entreprise, les propriétaires de patrimoine, les conseillers en placement agréés, les sociétés de capital-investissement et les partenaires. Quelle que soit la complexité de vos opérations - que vous gériez des familles multigénérationnelles ou des sociétés de capital-investissement nécessitant des capacités de vérification des investissements sous-jacents - notre plateforme transforme la complexité en efficacité rationalisée.

AtlasFive® associe une IA de pointe à une intégration de données avancée pour gérer plus de 270 flux de travail dans les domaines de la gestion des investissements, de la comptabilité, de la fiscalité, de la gestion des documents, du paiement des factures, du traitement des transactions, de la comptabilité des fonds, de la comptabilité fiduciaire et bien plus encore. Notre mission est simple : transformer vos défis en solutions transparentes, afin que vous puissiez atteindre vos objectifs avec clarté et confiance, quelle que soit la complexité de vos besoins.

Caractéristiques principales d'AtlasFive

Rationalisez les opérations de votre family office grâce à la plateforme intégrée AtlasFive®, la meilleure de sa catégorie, pour une efficacité accrue.

Comptabilité de base

Grand livre intégré, comptabilité des fiducies et des sociétés de personnes, et grand livre fiscal

Grand livre intégré en temps réel pour des opérations rationalisées.

- Plan comptable flexible, structures de reporting et regroupements illimités d'états financiers : Personnalisez votre cadre financier grâce à des structures de comptes adaptables et créez autant de groupes d'états financiers que votre entreprise le souhaite.

- Traitement automatisé des flux de données et création d'écritures comptables: Traite automatiquement les flux de données et génère des écritures de journal, réduisant ainsi le travail manuel et garantissant la précision.

- Rapprochement quotidien automatisé de la banque et du livre : Maintenez des dossiers à jour et précis grâce à un rapprochement automatisé quotidien de vos soldes bancaires et comptables.

- Rapports flexibles sur les états financiers, au niveau du résumé et du détail, avec des fonctions d'analyse détaillée au niveau de la transaction : Générer des états financiers à la fois sommaires et détaillés, avec la possibilité de détailler les transactions individuelles.

- Faites l'expérience d'une fermeture de période plus fluide grâce à AtlasLens, alimenté par l'IA : Réduisez les efforts et le temps nécessaires à la clôture des comptes grâce aux capacités d'intelligence artificielle d'AtlasLens.

AtlasFive® est la seule plateforme de gestion de patrimoine qui combine de manière transparente la comptabilité fiduciaire avec toutes les autres fonctions de votre bureau.

- Toutes les informations fiduciaires en un seul endroit: Maintenir un référentiel centralisé et structuré pour tous les détails relatifs aux trusts - bénéficiaires, constituants, trustees, types de trusts, et plus encore. Tout est interconnecté et facilement accessible dans votre environnement AtlasFive®.

- Suivi automatisé du capital et du revenu: AtlasFive® sépare et suit automatiquement le capital et les revenus, garantissant l'exactitude des distributions et de la comptabilité. Déclenchez les distributions de revenus et calculez les frais de fiducie directement à partir du système - aucune feuille de calcul n'est nécessaire.

- Rapports fiduciaires conçus à cet effet: Générer des rapports tels que l'état des résultats, l'état des actifs et l'activité du capital et des revenus en quelques clics. Aucune personnalisation n'est nécessaire - ils sont conçus pour répondre aux normes fiduciaires et réglementaires dès le premier jour.

- Restez conforme en toute confiance: Avec l'Automated Annual Account Review, AtlasFive® s'assure que toutes les activités fiduciaires sont régulièrement examinées et documentées, ce qui vous aide à assumer vos responsabilités fiduciaires avec facilité et transparence.

Module entièrement intégré et automatisé pour gérer tous vos besoins en matière de comptabilité de partenariat

- Adaptable à divers types de fonds : Fonctionne parfaitement avec les fonds spéculatifs, les fonds de capital-investissement, les fonds immobiliers, les fonds à tranches multiples, les fonds à poches latérales, les fonds de type marché monétaire et les fonds hybrides.

- Allocation automatisée du revenu net et calcul de la distribution (au prorata ou selon la méthode de la chute d'eau) : Gérer sans effort des allocations complexes, suivre les engagements de capital, les distributions, la valeur liquidative, les parts, le prix, le MOIC, le TRI, et plus encore, le tout dans une interface unique et conviviale.

- Le livre des comptes du partenariat se rapproche en toute transparence de votre grand livre et du livre des comptes des investissements : Éliminez les divergences grâce à une réconciliation entièrement intégrée entre les livres.

- EtonAI™ prend en charge l'extraction de données à partir des avis d'appel de fonds, des avis de distribution, des déclarations des gestionnaires, etc : Automatisez les flux de travail pour le traitement des transactions et l'évaluation au prix du marché grâce à l'extraction avancée de données.

Obtenez les informations nécessaires pour satisfaire à vos obligations en matière de déclaration fiscale.

- Classification fiscale automatisée et déclaration de tous les revenus et dépenses par catégories fiscales : Suivez facilement les détails fiscaux par relations, entités, comptes, titres et fonds, pour une visibilité et une précision totales.

- Utiliser le grand livre des impôts comme document de travail pour la déclaration des impôts estimés : Préparez et organisez vos déclarations fiscales estimées avec des documents de travail structurés et prêts à être contrôlés.

- Tous les documents liés à la fiscalité, tels que les déclarations fiscales, les contributions, etc., sont classés par type, par année ou par toute autre spécificité pour une référence rapide : Localisez et consultez rapidement tous vos documents fiscaux, organisés pour une efficacité maximale.

Gestion de portefeuille et rapports de performance

Une surveillance de niveau institutionnel avec une précision personnalisée : AtlasFive® permet aux gestionnaires de patrimoine et aux family offices de gérer les portefeuilles d'investissement avec la même rigueur que les investisseurs institutionnels, tout en s'adaptant aux besoins spécifiques des clients UHNW.

- Établir une stratégie et suivre les résultats: Définir des objectifs d'investissement, fixer des critères de référence personnalisés et suivre les objectifs du portefeuille par rapport aux résultats réels en temps réel. Créez des vues simultanées de portefeuilles multidevises adaptées aux clients, aux conseillers et aux auditeurs.

- Contrôles des liquidités et des affectations: Attribuer des seuils de liquidités minimum et maximum, configurer les préférences passives et actives, et fixer des objectifs de revenus pour aligner la construction du portefeuille sur les objectifs de liquidité, de rendement et de croissance de chaque famille.

De la complexité à la clarté : Convertir les données brutes d'un portefeuille en des informations exploitables avec des analyses riches, des visualisations dynamiques et des rapports de qualité pour les investisseurs, alimentés par AtlasFive® et EtonAI™.

- Vues unifiées de la valeur nette et du compte de résultat: Comprendre le patrimoine en un coup d'œil, à travers toutes les entités et tous les comptes, y compris les rapports de transparence sur les investissements sous-jacents et la synthèse entre les membres de la famille ou les structures.

- Tableaux de bord quotidiens des performances: Analysez instantanément la performance des investissements à travers les portefeuilles, les classes d'actifs, les zones géographiques, les secteurs, etc. En quelques clics, explorez les valeurs aberrantes, les tendances de performance ou les risques de concentration.

- Des idées alimentées par l'IA avec EtonAI™: Analyse automatique de l'allocation par rapport aux objectifs, signale les actifs les plus performants ou les moins performants et simule des scénarios de rééquilibrage, de besoins en liquidités ou d'évolution du marché à l'aide d'invites en langage naturel.

Gouvernance proactive des risques : Allez au-delà des rapports traditionnels grâce à l'analyse des risques pilotée par l'IA et aux workflows de conformité automatisés.

- Surveillance continue des risques: Les services d'assistance technique et d'assistance à la clientèle sont assurés par des spécialistes de l'assistance technique et de l'assistance à la clientèle, qui travaillent en étroite collaboration avec les services d'assistance technique et d'assistance à la clientèle.

- Gestion des exceptions: Les portefeuilles sont automatiquement signalés en cas de restrictions, de limites de concentration ou d'anomalies nécessitant une attention immédiate, ce qui permet d'aligner les portefeuilles sur le mandat et la réglementation.

- Recherche et évaluation renforcées par l'IA: Avec EtonAI™, évaluez les risques au niveau de la sécurité, comparez les états financiers, effectuez des études de marché et évaluez les documents des fonds d'investissement par rapport à des listes de contrôle des risques personnalisées.

Une image complète du patrimoine - à travers chaque classe d'actifs : AtlasFive® consolide tous les actifs financiers et personnels en une vue centralisée afin de soutenir la planification et la gestion holistique du patrimoine.

- Actifs négociables: Actions, obligations, revenus fixes, liquidités, bons du Trésor, ETF, fonds communs de placement.

- Alternatives: Fonds spéculatifs, fonds de fonds, capital-investissement, immobilier, capital-risque.

- Autres actifs non liquides: Polices d'assurance, intérêts commerciaux, art, bijoux, objets de collection.

- Patrimoine personnel: Maisons, voitures, avions, yachts - suivis avec précision et inclus dans le calcul de la valeur nette totale.

Créez et gérez efficacement des prêts en bénéficiant d'une visibilité et d'un contrôle complets.

- Suivi des prêts intra-entité et externes: Gérer les prêts internes et externes avec un stockage complet des données pour chaque prêt.

- Points de données centralisés: Stockez les informations détaillées sur les prêts en un seul endroit, ce qui améliore la précision et l'accessibilité.

- Mises à jour efficaces des transactions: Enregistrer des transactions qui mettent automatiquement à jour les dossiers du prêteur et de l'emprunteur, réduisant ainsi le travail manuel et augmentant l'efficacité du flux de travail.

Gestion des documents

Exploitez l'IA pour transformer le traitement des documents d'un stockage passif en une automatisation intelligente et en temps réel.

Les autorisations basées sur les rôles et les types garantissent un contrôle précis des personnes autorisées à consulter, modifier ou gérer des documents sur la plateforme. Une piste d'audit numérique complète enregistre automatiquement chaque action - chargement, téléchargement, modification, accès - garantissant une transparence totale et le respect des réglementations.

Qu'il s'agisse de la gestion de la relation client, du traitement des transactions, de l'examen annuel des comptes, de l'établissement de rapports à l'intention des clients ou d'autres activités, la gestion des documents fait partie intégrante des flux de travail quotidiens et n'est plus un point de détail.

EtonAIgency™ (agent web en instance de brevet) se connecte automatiquement aux portails sécurisés, en contournant le MFA, les captchas et les murs de jetons pour récupérer vos fichiers à votre place - sans aucun effort humain.

Fini le marquage manuel des documents. EtonAI™ extrait des données clés (montants, dates, entités, fonds, montants des paiements et plus encore) à partir de plus de 250 types de documents tels que des factures, des appels de fonds, des relevés bancaires/de gestion, des K-1 et des formulaires KYC, et ce, de manière instantanée et précise. Chaque document est automatiquement étiqueté, indexé et classé. Pas de tri. Pas de noms de fichiers. Pas de recherche de dossiers.

Tous les documents sont instantanément consultables en langage naturel et résumés, transformant le contenu non structuré en informations exploitables.

Gestion des entités

Tout voir. Tout contrôler. En un seul endroit. La solution Entity Management d'AtlasFive® unifie l'ensemble de votre réseau patrimonial - clients, entités, propriétés, portefeuilles, comptes et relations - au sein d'une plateforme unique et intelligente.

Suivez chaque family office, trust, LLC, partenariat ou holding grâce à des profils détaillés et des connexions en temps réel. Obtenez une image complète de chaque entité ou personne : coordonnées, comptes, documents, activités et relations liées, le tout centralisé et actualisé.

Avec AtlasFive®, votre reporting financier est rationalisé et unifié à travers les entités mondiales. Le plan comptable mondial simplifie la consolidation et le suivi des performances financières, permettant un reporting clair et cohérent quelles que soient les différences géographiques ou juridictionnelles.

Adaptez le système aux besoins spécifiques de votre family office en créant des champs et des modèles de données personnalisables. Cette flexibilité garantit qu'AtlasFive® s'adapte à votre façon de travailler, et non l'inverse, permettant ainsi à votre équipe de se concentrer sur des tâches à forte valeur ajoutée, et non sur des configurations manuelles.

Gestion de trésorerie

Simplifiez le cycle de vie de vos paiements tout en maintenant le contrôle et la conformité entre les fournisseurs, les dépositaires et les banques.

- Passerelle de paiement intégrée : Lancez des instructions de paiement directement depuis AtlasFive® vers les dépositaires, les banques, les fonds et les vendeurs avec un support complet pour l'impression de chèques, les ACH standard et du jour même, les fils nationaux et internationaux, les transferts de compte à compte et les transactions Positive Pay.

- BILL Intégration : Grâce à notre intégration avec BILL, vous pouvez payer vos fournisseurs sans effort en utilisant les comptes de n'importe quelle banque américaine, ce qui minimise les frictions et augmente la flexibilité des opérations de trésorerie.

- Automatisation des factures grâce à l'IA : EtonAI™ extrait automatiquement les données des factures et des bordereaux en créant des flux de travail dans AtlasFive's®, ce qui permet de réduire les efforts manuels, les erreurs humaines et d'accélérer les flux d'approbation.

Augmentez l'efficacité opérationnelle grâce à des flux de travail améliorés par l'IA qui automatisent la reconnaissance et l'exécution des transactions.

- Extraction automatisée de données à partir de plus de 250 types de documents financiers : EtonAI™ extrait les données des avis d'appel de fonds, des avis de distribution, des déclarations des gestionnaires, et plus encore, en créant des flux de travail pour un traitement transparent des transactions et des mises à jour de l'évaluation au marché dans AtlasFive®.

- OCR contextuelle avec intelligence intégrée

Notre OCR contextuelle en instance de brevet tire parti de l'apprentissage automatique, d'EtonAI™, d'AtlasFive® CRM Knowledge Graph et des transactions mémorisées pour identifier automatiquement les informations critiques à partir des images de documents - aucune formation manuelle n'est nécessaire. - Étiquetage intelligent des transactions et exécution des paiements

Marquez les documents pour les associer à des transactions, des entités ou des comptes et initiez des paiements par appel de fonds directement depuis AtlasFive®, garantissant ainsi une automatisation et une traçabilité de bout en bout au sein de votre écosystème financier.

Planifiez avec précision. AtlasFive® vous permet de prévoir et de modéliser les liquidités en toute confiance.

- Modélisation flexible de flux financiers complexes : Modéliser les flux de trésorerie récurrents et ponctuels adaptés à des entités spécifiques, tels que les contributions trimestrielles ou les décaissements liés à des événements, afin de garantir une planification plus précise des liquidités.

- Ordonnancement au niveau de l'entité : Définir des calendriers de contribution et de retrait variables selon les entités, ce qui permet un contrôle granulaire de la position des liquidités à court et à long terme.

- Rapports exportables et personnalisables : Générer des rapports sur les transactions prévues pour les intégrer dans des rapports personnalisés ou des tableaux de bord analytiques, en vous donnant une transparence et un contrôle complets sur les mouvements de trésorerie prévus.

Rapports sur les clients : Des informations instantanées et personnalisées

- Rapports pré-établis: Accédez à plus de 50 rapports prêts à l'emploi dans les domaines de l'investissement, de la comptabilité générale, de la conformité et plus encore, y compris des tableaux de bord quotidiens sur les performances et la comptabilité.

- Tableaux de bord personnalisés: Utilisez les API de reporting d'AtlasFive® pour créer vos propres solutions de reporting.

- Intégration de Power BI: Explorez et décomposez facilement les données AtlasFive® avec les outils Power BI.

- Analyse du langage naturel: Tirez parti d'EtonAI™ pour analyser les rapports, générer des insights et les traduire en plusieurs langues.

Intégration des données

- Accès à plus de 1 500 banques et dépositaires, directement ou par l'intermédiaire de nos partenaires agrégateurs.

- Traitement et agrégation automatisés quotidiens des flux de données à l'aide d'un moteur de règles commerciales basé sur l'IA.

- Les documents traités comprennent les relevés de courtage, les relevés des gestionnaires, les factures, les avis d'appel de fonds, les avis de distribution, les formulaires fiscaux, etc. Vous pouvez également tirer parti de notre technologie OCR contextuelle en instance de brevet pour extraire des données de ces documents.

- L'équipe Eton Solutions Services aide au traitement des relevés et à l'extraction des données du portail, y compris la migration des données historiques.

Flux de travail et piste d'audit

- Des flux de travail sur mesure: Créez des chemins de tâches personnalisés qui correspondent aux opérations de votre bureau, des approbations aux transactions, afin que rien ne passe entre les mailles du filet.

- Contrôle d'accès intelligent: Permettre aux bonnes personnes d'accéder aux actifs, rapports et documents appropriés, en protégeant les données sensibles dès la conception.

- Piste d'audit complète: Chaque clic, connexion, modification ou téléchargement est suivi, ce qui vous permet de disposer d'un enregistrement complet et sécurisé pour assurer la conformité et la tranquillité d'esprit.

Intelligence artificielle

EtonAI™ (précédemment EtonGPT™) s'appuie sur une puissante combinaison des meilleures technologies d'IA pour optimiser les processus et améliorer l'efficacité de manière efficace.

Numérisez et automatisez les traces écrites : EtonAI™ élimine la saisie manuelle des données et le chaos des documents grâce à l'automatisation intelligente de plus de 250 types de documents - offrant rapidité, précision et conformité.

- Extraction instantanée de données dans tous les types de documents: Des factures et appels de fonds aux K-1, relevés bancaires/gestionnaires et formulaires KYC-EtonAI™ extrait les informations clés (dates, montants, entités, fonds, etc.) avec précision, à l'aide d'une ROC avancée, de grands modèles linguistiques (LLM) et d'un enrichissement contextuel.

- Collecte de documents sans effort via EtonAIgency™ (brevet en instance) : Récupère automatiquement les documents à partir de portails Web sécurisés, en contournant les captchas, le MFA et les murs de connexion, pour que votre équipe n'ait pas à le faire. Pas d'e-mails, pas de téléchargements, pas de connexions - juste des données à portée de main.

- Organisé, classé et indexé automatiquement: Chaque document est trié, étiqueté et classé sans intervention humaine. Il n'est pas nécessaire de renommer les fichiers ou d'organiser les dossiers : l'interface utilisateur s'en charge instantanément.

- Comprendre le contexte, pas seulement le texte: Grâce à l'OCR + les LLM + le graphe de connaissances ICL (brevet en instance), EtonAI™ comprend les relations entre les comptes, les transactions et les entités - ce qui améliore la précision de l'extraction, réduit le travail de reprise et améliore la préparation à l'audit.

- Du document au flux de travail en quelques secondes: Déclencher des actions en aval directement à partir des documents. Les factures déclenchent le paiement des factures. Les appels de fonds déplacent les liquidités. Les évaluations mettent à jour la valeur de marché. Le tout piloté par un moteur de règles de gestion personnalisable.

Transformez le langage naturel en intelligence de portefeuille : EtonAI™ Portal transforme la façon dont les équipes accèdent, interrogent et agissent sur les données privées - aucune compétence technique n'est requise.

- Front-end conversationnel pour les données privées: Posez des questions telles que "Montrez-moi les fonds les plus performants par TRI" ou "Résumez les appels de fonds du dernier trimestre". EtonAI™ interprète le langage naturel et fournit des réponses directes à partir de votre instance AtlasFive® privée.

- Recherche sémantique de documents: Notre base de données vectorielle regroupe, intègre et indexe des centaines de milliers de documents, ce qui permet une recherche sémantique et une récupération rapides, sans aucune contrainte de taille.

- Télécharger, analyser, résumer - n'importe quel type de fichier: Télécharger des PDF, des images, des feuilles de calcul,. EtonAI™ convertit tout en texte structuré et fournit des résumés, des traductions ou des extractions en quelques secondes.

- Recherche en ligne intégrée pour une meilleure connaissance du marché: Accédez à des informations en temps réel et à des données financières externes en toute sécurité, sans changer d'onglet ni utiliser d'outils externes. Idéal pour la recherche en investissement et le suivi des gestionnaires.

- Intelligence multilingue et multimodale: Traduisez des rapports, résumez des documents en langue étrangère, expurgez et narrez des fichiers sensibles ou convertissez des infographies en données exploitables, et ce de manière automatique.

- Visualisations dynamiques, générées instantanément: Visualisez les tendances d'investissement, les structures familiales de propriété ou la performance du portefeuille sous forme de diagrammes à barres exportables, de diagrammes de dispersion, d'arbres généalogiques ou de rapports Excel, grâce à la visualisation dynamique en instance de brevet d'Eton.

- Power BI + AutoML pour une analyse plus approfondie: Découpez des rapports à l'aide de l'AutoML de Power BI, directement via le portail. Permettez aux équipes non techniques d'explorer, de détecter des modèles et d'obtenir de nouvelles informations sans avoir à coder.

La confiance intégrée à chaque interaction : EtonAI™ est conçu avec la responsabilité au cœur, garantissant que vos données sont protégées, que les décisions sont explicables et que les limites éthiques ne sont jamais franchies.

- Sécuriser l'infrastructure de l'IA avec le GPT privé: EtonAI™ s'exécute dans une instance dédiée et privée - ce qui signifie que vos données ne sont jamais partagées, jamais exposées et jamais utilisées pour entraîner des modèles publics. Vos informations sensibles sur les clients et les investissements restent à l'intérieur de votre environnement AtlasFive®, en permanence.

- Certification ISO 42001 pour le système de gestion de l'intelligence artificielle: Eton est fière d'être l'une des premières plateformes de gestion de patrimoine à obtenir la certification ISO/IEC 42001, la norme internationale pour les systèmes de gestion de l'intelligence artificielle. Cette certification reflète notre engagement profond en faveur d'une utilisation éthique et responsable de l'IA, et nous aide à établir et à maintenir la confiance avec nos clients et nos parties prenantes. Elle garantit l'alignement sur les exigences réglementaires et légales en constante évolution, une gestion efficace des risques liés à l'IA et favorise l'innovation dans un cadre de gouvernance structuré et responsable. Chez Eton, l'IA n'est pas seulement intelligente - elle est sûre, transparente et digne de confiance.

- Une IA explicable à laquelle vous pouvez faire confiance: EtonAI™ fournit non seulement des réponses, mais aussi un raisonnement. Grâce aux cadres d'IA causale et explicable, chaque prédiction ou suggestion est étayée par une logique traçable - donnant aux utilisateurs et aux équipes de conformité la visibilité dont ils ont besoin pour faire confiance aux aperçus automatisés.

- Enregistrement d'invites pour l'auditabilité: Chaque demande, chaque interaction avec EtonAI™ est enregistrée. Cela permet une traçabilité et une responsabilité totales, de sorte que vous savez toujours comment, pourquoi et quand une décision a été prise - à l'appui des audits, des examens internes et des rapports de conformité.

- Pas d'hallucinations, juste des faits: Grâce à une architecture hybride qui combine des données en temps réel, des documents et des enregistrements structurés, EtonAI™ minimise le risque de réponses hallucinées - garantissant que les décisions sont fondées sur une vérité vérifiée, et non sur des suppositions.

EtonAI™ rassemble les blocs de construction d'IA les plus avancés au monde, adaptés spécifiquement aux besoins des Family Offices, des conseillers en investissement et des institutions patrimoniales.

- Infrastructure d'IA privée et native dans le nuage: La sécurité rencontre l'évolutivité. EtonAI™ s'exécute sur une infrastructure cloud-native dédiée, entièrement sans serveur, chiffrée et isolée. Vos charges de travail d'IA sont traitées en toute sécurité - complètement séparées de tout trafic d'IA public.

- Grands modèles linguistiques hybrides (LLM): Eton combine des LLM d'entreprise pour offrir un mélange parfait d'intelligence, de performance et de rentabilité. Cette stratégie multi-modèle garantit des résultats optimaux pour diverses tâches telles que l'extraction, le résumé ou l'étude de marché, et ce à chaque fois.

- Génération Augmentée de Récupération (RAG): Allez au-delà des modèles statiques. EtonAI™ utilise l'architecture RAG pour ancrer les réponses de l'IA dans vos données et documents AtlasFive® réels. Cela garantit des réponses précises, en temps réel, basées sur ce qui est vrai - et non sur ce qui est probable.

- Base de données vectorielle: Grâce à notre base de données vectorielle, les documents sont regroupés, indexés et vectorisés, ce qui permet une recherche sémantique dans le référentiel documentaire d'AtlasFive®.

- Graphique de connaissances ICL (brevet en instance): Le graphe de connaissances ICL d'Eton découvre les liens cachés entre les entités, les comptes et les transactions, offrant une précision inégalée dans l'extraction des données et la compréhension du contexte. Ce n'est pas seulement de la lecture, c'est du raisonnement.

- Reconnaissance optique de caractères (OCR) avancée: Des appels de fonds numérisés aux notes manuscrites, EtonAI™ voit tout. Notre pipeline OCR, amélioré par un prétraitement alimenté par LLM, garantit une extraction de données de haute précision, même à partir de fichiers non structurés ou de faible qualité. (Brevet en instance)

- Moteur de règles de gestion (BRE): Avec plus de 450 règles spécifiques aux family offices, notre BRE automatise les processus tels que les mises à jour de la valeur de marché, la reconnaissance des positions, la validation des transactions et bien plus encore, garantissant ainsi l'intégrité opérationnelle à grande échelle.

Cybersécurité et vie privée

Eton Solutions a fourni l'infrastructure la plus performante pour le secteur de la gestion de patrimoine, en intégrant une intelligence des menaces basée sur l'IA.

- Contrôle continu : Le centre d'opérations de sécurité (SOC) surveille en temps réel l'infrastructure et le flux de données.

- Réponse immédiate à l'incident : Alertes et réponses instantanées en cas d'anomalies, de brèches ou de tentatives d'intrusion.

- Déploiement isolé : Les clients opèrent sur des instances Azure isolées à locataire unique avec des clés de chiffrement optionnelles gérées par le client (BYOK).

- Cryptage des données : Données et documents cryptés au repos et en transit avec les protocoles AES-256 et TLS.

- Contrôles d'accès : L'accès basé sur les rôles et au niveau de l'entité limite les autorisations des utilisateurs, ce qui garantit une séparation opérationnelle.

- Architecture résiliente : Conception "cloud-native" avec sauvegardes automatisées, stockage immuable et basculement géographiquement redondant.

- Certifications et conformité : Certifié pour ISO 42001 (intelligence artificielle), ISO 27001 (sécurité de l'information), ISO 27701 (confidentialité), SOC 1 Type II & SOC 2 Type II (contrôles des systèmes et de l'organisation), et conforme au GDPR (règlement général sur la protection des données) et au CCPA (loi californienne sur la protection de la vie privée des consommateurs).

- LLM privés : L'IA fonctionne sur de grands modèles linguistiques privés sans partage de données externes.

- Résultats explicables de l'IA: Les résultats de l'IA sont traçables, explicables et limités à l'accès aux données au niveau de l'utilisateur, conformément aux principes de la norme ISO 42001.

- L'authentification unique (SSO) : Authentification sécurisée des utilisateurs simplifiant la gestion des accès.

- Authentification multifactorielle (MFA) : Sécurité renforcée grâce à des couches d'authentification supplémentaires, alignées sur les normes de l'entreprise.

Native de l'informatique en nuage

AtlasFive® est spécialement conçu sur une architecture cloud-native, sans serveur, qui transforme l'économie et l'agilité des opérations de gestion de patrimoine - en offrant résilience, vitesse et échelle sans aucune charge d'infrastructure.

- Conception sans serveur : L'architecture cloud-native conçue à cet effet offre résilience, rapidité et évolutivité sans aucune charge d'infrastructure.

- Sans entretien: Pas de serveurs à entretenir, pas de rafraîchissement du matériel et pas de réglage de la base de données.

- Changement d'orientation : Libère les équipes de la maintenance des systèmes à faible valeur ajoutée pour qu'elles se concentrent sur le service à la clientèle et la croissance stratégique.

- Pay-As-You-Go : Ne payez que ce que vous utilisez, ce qui élimine les coûts d'infrastructure inutilisés et permet d'aligner les dépenses sur la demande réelle.

- Performance évolutive : Modifie automatiquement la puissance de calcul et le stockage lors d'événements financiers critiques tels que les rapports de fin de mois ou la volatilité des marchés.

- Pas de temps d'arrêt : La mise à l'échelle s'effectue sans intervention manuelle ni temps d'arrêt du système.

- Mises à jour invisibles : Les mises à jour et les correctifs de sécurité fournis en continu par le cloud sont exécutés en arrière-plan, ce qui garantit la conformité et la sécurité sans interruption de l'activité informatique.

- Infrastructure résiliente : Des systèmes redondants répartis géographiquement garantissent une disponibilité ininterrompue.

- Reprise après sinistre : Conçu pour maintenir les opérations même en cas de panne ou de catastrophe naturelle.

Continuité des activités

AtlasFive® veille à ce que vos opérations de gestion de patrimoine ne soient pas interrompues. Grâce à des stratégies de sauvegarde et de reprise après sinistre à la pointe de l'industrie, les données de votre entreprise sont protégées, toujours accessibles et toujours en ligne.

AtlasFive® effectue des sauvegardes incrémentielles toutes les cinq minutes, combinées à une sauvegarde quotidienne complète. Ainsi, même en cas de panne imprévue, vos données les plus récentes restent en sécurité, ce qui minimise l'interruption des services aux clients et de la gestion des portefeuilles.

AtlasFive® est hébergé dans plusieurs centres de données à travers le monde, avec une réplication à chaud de l'ensemble de votre instance. Cela signifie qu'en cas de défaillance d'un site, votre serveur de secours est immédiatement prêt à prendre le relais, sans aucun temps d'arrêt, ce qui garantit la continuité de l'activité et la confiance des clients.

Grâce à une infrastructure cloud distribuée à l'échelle mondiale, AtlasFive® garantit que vos opérations restent opérationnelles, quels que soient les défis géographiques, les catastrophes naturelles ou les cyber-menaces. Il n'y a pas de temps mort - votre activité de gestion de patrimoine est toujours opérationnelle.

Un processus de mise en œuvre adapté à vos besoins

Contrairement à d'autres soi-disant "plates-formes intégrées" sur le marché, nous avons construit AtlasFive® dans le seul but de résoudre les défis auxquels les sociétés de gestion de patrimoine sont confrontées chaque jour.

Nos fondateurs et nos dirigeants ont fait carrière dans l'industrie de la gestion de patrimoine. L'expérience approfondie de notre équipe dans le secteur signifie que chaque flux de travail et chaque structure de données s'alignent sur les pratiques du monde réel, afin que vous puissiez migrer de vos systèmes existants vers AtlasFive® de manière transparente et commencer à fournir de la valeur dès le premier jour.

Choisir AtlasFive®, c'est s'associer à un partenaire qui s'investit dans votre réussite, au-delà de la mise en production. Notre centre de service mondial propose des formations pratiques, des dépannages réactifs et des conseils proactifs afin que votre équipe maîtrise rapidement la plateforme, maximise la productivité et minimise les interruptions. Avec des experts dédiés disponibles 24 heures sur 24, vous constaterez une adoption plus rapide, un retour sur investissement plus élevé et des améliorations continues adaptées à l'évolution de vos besoins.

Cartographie des processus grâce à l'expertise du domaine.

Nous avons vécu vos problèmes, compris les divers besoins des family offices, conçu notre système en fonction de ces besoins grâce à notre expertise dans le domaine, et nous pouvons gérer des structures et des transactions d'entités complexes.