Capacidades de AtlasFive

Consigue más con AtlasFive®, el software de gestión patrimonial de última generación, mejorado por EtonAI™ (antes EtonGPT™)

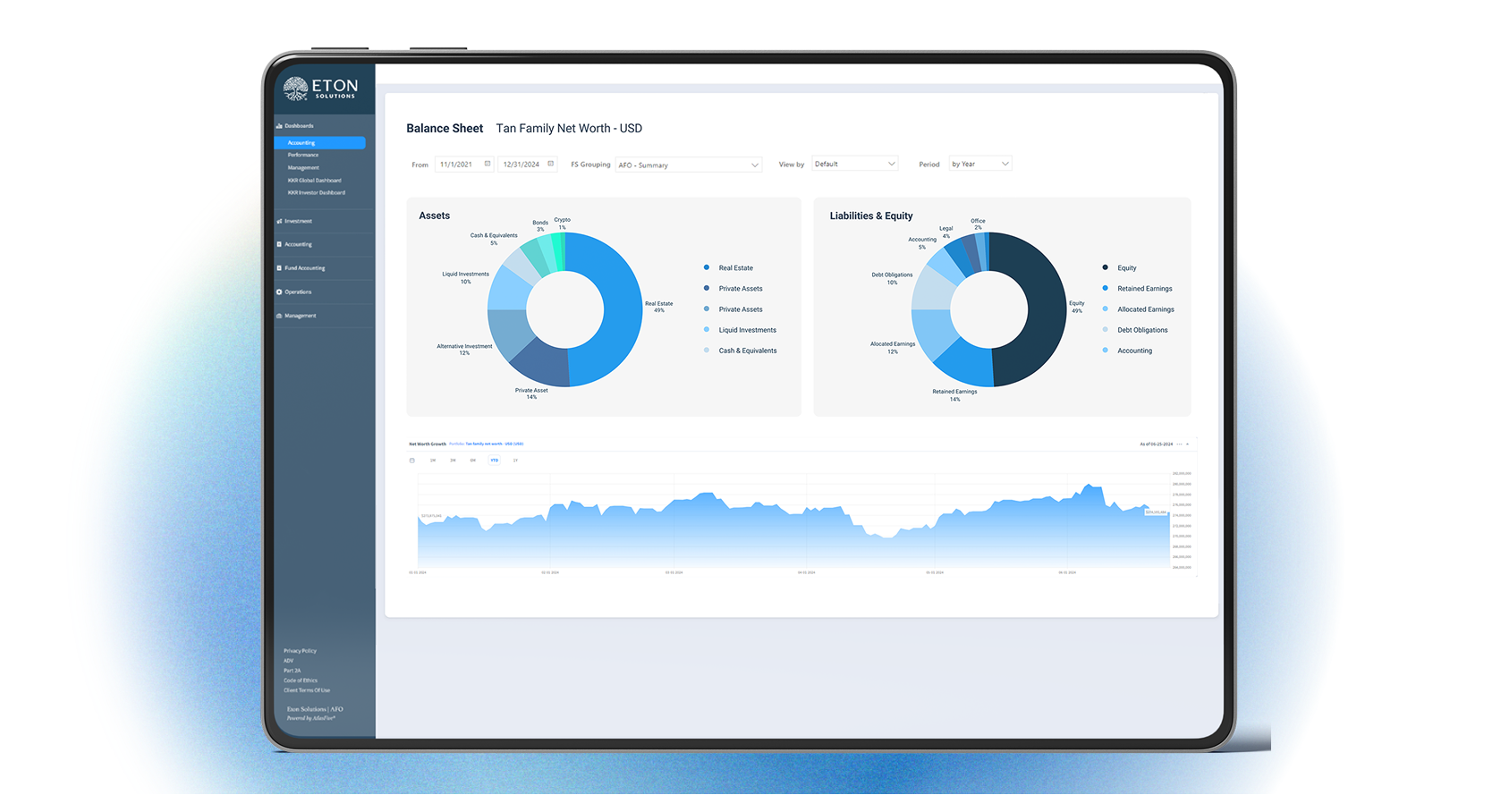

Al aprovechar las tecnologías de inteligencia artificial nativas de la nube, la mejor ciberseguridad de su clase y la gobernanza de datos avanzada, junto con una experiencia de dominio inigualable, Eton Solutions está ayudando a las empresas de gestión de patrimonios a evolucionar hacia un marco de entrega híbrido AI-HumAIn™. Nuestra plataforma nativa en la nube, AtlasFive®, ha establecido el punto de referencia para las mejores prácticas del sector de la gestión de patrimonios que va más allá de las capacidades tradicionales de agregación de datos y generación de informes.

AtlasFive® es la plataforma de gestión de patrimonios más avanzada que integra gestión de entidades, gestión de carteras, contabilidad general y de fondos, procesamiento de transacciones, gestión de documentos y mucho más en un ecosistema digital unificado. La plataforma cuenta con la confianza de Single Family Offices, Multi Family Offices, Wealth Owners, RIAs, Business Managers, Private Equity a nivel global, gestionando más de $936 billones en activos.

Fuente única de la verdad

Eton Solutions simplifica sus operaciones de gestión patrimonial unificando sus datos de inversión, contabilidad e impuestos en un sistema integrado.

Diga adiós a la frustración de conciliar datos en múltiples herramientas. Nuestra plataforma proporciona una fuente de información coherente y fiable, garantizando un acceso fluido a los datos para una toma de decisiones más inteligente. Al ser la única solución de IA totalmente integrada para la gestión de patrimonios, sentamos las bases para una visión impulsada por la IA, ayudándole a liberar todo el potencial de sus datos.

Su complejidad es nuestra simplicidad

En Eton Solutions, nos esforzamos por simplificar las complejidades de la gestión de patrimonios para nuestros diversos clientes, incluyendo Single Family Offices, Multi Family Offices, Gestores de Empresas, Propietarios de Patrimonios, Asesores de Inversión Registrados, Private Equity y Socios. No importa lo complejas que sean sus operaciones, tanto si gestiona familias multigeneracionales como empresas de capital riesgo que requieren capacidades de seguimiento de las inversiones subyacentes, nuestra plataforma convierte la complejidad en eficiencia racionalizada.

AtlasFive® combina IA de vanguardia con integración de datos avanzada para gestionar más de 270 flujos de trabajo en gestión de inversiones, contabilidad, impuestos, gestión de documentos, pago de facturas, contabilidad de fondos de procesamiento de transacciones, contabilidad de fideicomisos y mucho más. Nuestra misión es sencilla: convertir sus retos en soluciones sin fisuras, para que pueda alcanzar sus objetivos con claridad y confianza, independientemente de la complejidad de sus necesidades.

Principales características de AtlasFive

Agilice las operaciones de su family office con la plataforma integrada AtlasFive®, la mejor de su clase, para mejorar la eficiencia.

Contabilidad básica

Libro mayor, contabilidad fiduciaria, contabilidad de sociedades y libro fiscal integrados

Libro mayor integrado en tiempo real para agilizar las operaciones.

- Plan de cuentas flexible, estructuras de informes y agrupaciones ilimitadas de estados financieros: Personalice su marco financiero con estructuras de cuentas adaptables y cree tantas agrupaciones de estados financieros como necesite su empresa.

- Procesamiento automatizado de datos y creación de asientos: Procese automáticamente los datos y genere asientos, reduciendo el trabajo manual y garantizando la precisión.

- Conciliación bancaria y contable diaria automatizada: Mantenga registros actualizados y precisos con la conciliación diaria automatizada de sus saldos bancarios y contables.

- Informes de estados financieros flexibles a nivel de resumen y de detalle con funciones de desglose a nivel de transacción: Genere estados financieros tanto resumidos como detallados, con la posibilidad de desglosar las transacciones individuales.

- Disfrute de un Cierre de Periodo más fluido con AtlasLens, basado en IA: Reduzca el esfuerzo y el tiempo necesarios para cerrar los libros con la ayuda de las capacidades de inteligencia artificial de AtlasLens.

AtlasFive® es la única plataforma de gestión de patrimonios que combina a la perfección la contabilidad fiduciaria con todas las demás funciones de su oficina.

- Toda la información fiduciaria en un solo lugar: Mantenga un repositorio centralizado y estructurado de todos los detalles relacionados con los fideicomisos: beneficiarios, otorgantes, fideicomisarios, tipos de fideicomiso y mucho más. Todo está interconectado y es fácilmente accesible desde su entorno AtlasFive®.

- Seguimiento automatizado del capital y los ingresos: AtlasFive® separa y controla automáticamente el capital y los ingresos, garantizando la precisión en las distribuciones y la contabilidad. Active las distribuciones de ingresos y calcule las comisiones fiduciarias directamente desde el sistema, sin necesidad de hojas de cálculo.

- Informes fiduciarios a medida: Genere informes como la cuenta de resultados, la cuenta de activos y la actividad de capital e ingresos con sólo unos clics. No es necesario personalizarlos: están diseñados para cumplir las normas fiduciarias y reglamentarias desde el primer día.

- Cumpla la normativa con confianza: Con la Revisión Anual de Cuentas Automatizada, AtlasFive® garantiza que toda la actividad fiduciaria se revise y documente periódicamente, ayudándole a cumplir con sus responsabilidades fiduciarias con facilidad y transparencia.

Módulo totalmente integrado y automatizado para gestionar todas sus necesidades de contabilidad de sociedades.

- Adaptable a diversos tipos de fondos: Funciona a la perfección con fondos de cobertura, fondos de capital inversión, fondos inmobiliarios, fondos multitramo, fondos con carteras laterales, fondos de estilo mercado monetario y fondos híbridos.

- Asignación automatizada de los ingresos netos y cálculo de la distribución (método de prorrateo a cascada): Gestione sin esfuerzo asignaciones complejas, realice un seguimiento de los compromisos de capital, las distribuciones, el valor liquidativo, las participaciones, el precio, el MOIC, la TIR y mucho más, todo ello en una única interfaz fácil de usar.

- El Libro de Registro de Sociedades se concilia perfectamente con el Libro Mayor y el Libro de Registro de Inversiones: Elimine las discrepancias con una conciliación entre libros totalmente integrada.

- EtonAI™ admite la extracción de datos de Avisos de Llamada de Capital, Avisos de Distribución, Declaraciones del Gestor, etc: Automatice los flujos de trabajo para el procesamiento de transacciones y la valoración a precios de mercado con la extracción avanzada de datos.

Obtenga la información necesaria para cumplir sus obligaciones fiscales.

- Clasificación fiscal automatizada y notificación de todos los ingresos y gastos por categorías fiscales: Siga fácilmente los detalles fiscales por relaciones, entidades, cuentas, valores y fondos, garantizando una visibilidad y precisión totales.

- Utilizar el Libro Mayor de Impuestos como documentos de trabajo para la declaración de impuestos estimados: Prepare y organice sus declaraciones de impuestos estimadas con documentos de trabajo estructurados y listos para la auditoría.

- Todos los documentos relacionados con los impuestos, como la declaración de la renta, las contribuciones, etc., se separan por tipo, año o cualquier otra especificación para una consulta rápida: Localice y consulte rápidamente todos sus documentos fiscales, organizados para lograr la máxima eficacia.

Gestión de carteras e informes de resultados

Supervisión de nivel institucional con precisión personalizada: AtlasFive® permite a los gestores de patrimonios y a las family offices gestionar carteras de inversión con el mismo rigor que los inversores institucionales, sin dejar de ser flexibles ante las necesidades únicas de los clientes UHNW.

- Establecimiento de estrategias y seguimiento de resultados: Defina objetivos de inversión, establezca puntos de referencia personalizados y realice un seguimiento de los objetivos de la cartera frente a los reales en tiempo real. Cree vistas simultáneas de carteras multidivisa adaptadas a clientes, asesores y auditores.

- Controles de caja y asignación: Asigne umbrales de efectivo mínimos y máximos, configure preferencias pasivas frente a activas y establezca objetivos de ingresos para alinear la construcción de la cartera con los objetivos de liquidez, rendimiento y crecimiento de cada familia.

De la complejidad a la claridad: Convierta los datos brutos de la cartera en ideas prácticas con análisis enriquecidos, visualizaciones dinámicas e informes de calidad para inversores, impulsados por AtlasFive® y EtonAI™.

- Vistas unificadas del patrimonio neto y las pérdidas y ganancias: Comprenda el patrimonio de un vistazo, en todas las entidades y cuentas, incluidos los informes Look-Through de las inversiones subyacentes y el roll-up entre miembros o estructuras familiares.

- Cuadros de mando diarios: Analice al instante el rendimiento de las inversiones en carteras, clases de activos, zonas geográficas, sectores, etc. Explore los valores atípicos, las tendencias de rentabilidad o los riesgos de concentración con unos pocos clics.

- Perspectivas potenciadas por IA con EtonAI™.: Analice automáticamente la asignación frente a los objetivos, marque los activos más rentables o menos rentables y simule escenarios hipotéticos de reequilibrio, necesidades de liquidez o cambios en el mercado mediante mensajes en lenguaje natural.

Gobernanza proactiva del riesgo: Vaya más allá de los informes tradicionales con análisis de riesgos impulsados por IA y flujos de trabajo de cumplimiento automatizados.

- Supervisión continua de los riesgos: Realización de revisiones anuales automatizadas de cuentas de inversión mediante flujos de trabajo estructurados y repetibles que validan datos financieros y no financieros.

- Gestión de excepciones: Señale automáticamente las participaciones restringidas, los límites de concentración o las anomalías que requieran atención inmediata, para que sus carteras se ajusten tanto al mandato como a la normativa.

- Investigación y evaluación mejoradas con IA: Con EtonAI™, evalúe los riesgos a nivel de valores, compare estados financieros, realice estudios de mercado y evalúe documentos de fondos de inversión comparándolos con listas de comprobación de riesgos personalizadas.

Una imagen completa de la riqueza, en todas las clases de activos: AtlasFive® consolida todos los activos financieros y personales en una vista centralizada para apoyar la planificación y gestión holística del patrimonio.

- Activos negociables: Acciones, Bonos, Renta Fija, Efectivo, T-Bills, ETFs, Fondos de Inversión.

- Alternativas: Fondos de cobertura, Fondos de fondos, Capital inversión, Inmobiliario, Capital riesgo.

- Otros activos ilíquidos: Pólizas de seguros, intereses comerciales, arte, joyas, objetos de colección.

- Patrimonio personal: Viviendas, coches, aviones, yates... rastreados con precisión e incluidos en los cálculos del patrimonio neto total.

Cree y gestione préstamos de forma eficiente con total visibilidad y control.

- Seguimiento de préstamos internos y externos: Gestione préstamos internos y externos con un almacenamiento de datos exhaustivo para cada préstamo.

- Puntos de datos centralizados: Almacene información detallada sobre préstamos en un solo lugar, mejorando la precisión y la accesibilidad.

- Actualizaciones eficaces de las transacciones: Contabilice transacciones que actualicen automáticamente los registros del prestamista y del prestatario, reduciendo el esfuerzo manual y aumentando la eficiencia del flujo de trabajo.

Gestión de documentos

Aproveche la IA para transformar la gestión de documentos del almacenamiento pasivo a la automatización inteligente en tiempo real.

Los permisos basados en funciones y tipos garantizan un control preciso sobre quién puede ver, editar o gestionar documentos en toda la plataforma. Una completa pista de auditoría digital registra automáticamente todas las acciones -cargas, descargas, modificaciones, accesos- para garantizar la total transparencia y el cumplimiento de la normativa.

Incluyendo CRM, procesamiento de transacciones, revisiones anuales de cuentas, informes de clientes y mucho más, la gestión de documentos se convierte en una parte nativa de los flujos de trabajo diarios, no en una ocurrencia tardía.

EtonAIgency™ (agente web pendiente de patente) inicia sesión automáticamente en portales seguros, eludiendo MFA, captchas y token walls para obtener sus archivos por usted, sin necesidad de esfuerzo humano.

Se acabó el etiquetado manual de documentos. EtonAI™ extrae datos clave (importes, fechas, entidades, fondos, importes de pago, etc.) de más de 250 tipos de documentos, como facturas, peticiones de capital, extractos bancarios/de gerentes, K-1 y formularios KYC, de forma instantánea y precisa. Todos los documentos se etiquetan, indexan y clasifican automáticamente. Sin clasificación. Sin nombrar archivos. Sin búsqueda de carpetas.

Todos los documentos se pueden buscar instantáneamente en lenguaje natural y se resumen, convirtiendo el contenido no estructurado en inteligencia procesable.

Gestión de entidades

Verlo todo. Controlarlo todo. Todo en un solo lugar. La gestión de entidades de AtlasFive® unifica toda su red patrimonial -clientes, entidades, propiedades, carteras, cuentas y relaciones- en una única plataforma inteligente.

Realice un seguimiento de cada family office, trust, LLC, sociedad o holding con perfiles detallados y conexiones en tiempo real. Obtenga una imagen completa de cada entidad o persona: información de contacto, cuentas, documentos, actividades y relaciones vinculadas, todo centralizado y actualizado.

Con AtlasFive®, sus informes financieros se racionalizan y unifican en todas las entidades globales. El Plan General de Contabilidad simplifica la consolidación y el seguimiento del rendimiento financiero, lo que permite elaborar informes claros y coherentes independientemente de las diferencias geográficas o jurisdiccionales.

Adapte el sistema a los requisitos específicos de su family office creando campos y modelos de datos personalizables. Esta flexibilidad garantiza que AtlasFive® se adapte a su forma de trabajar, y no al revés, lo que permite a su equipo centrarse en tareas de valor añadido y no en configuraciones manuales.

Gestión de tesorería

Simplifique el ciclo de vida de sus pagos al tiempo que mantiene el control y la conformidad entre proveedores, depositarios y bancos.

- Pasarela de pagos integrada: Inicie instrucciones de pago directamente desde AtlasFive® a custodios, bancos, fondos y proveedores con soporte completo para impresión de cheques, ACH estándar y en el mismo día, transferencias nacionales e internacionales, transferencias de cuenta a cuenta y transacciones de pago positivo.

- Integración BILL: Pague sin esfuerzo a sus proveedores utilizando cuentas de cualquier banco estadounidense gracias a nuestra integración con BILL, minimizando las fricciones y aumentando la flexibilidad de las operaciones de tesorería.

- Automatización de facturas mediante IA: EtonAI™ extrae automáticamente datos de facturas y recibos creando flujos de trabajo en AtlasFive's®-recortando el esfuerzo manual, reduciendo el error humano y acelerando los flujos de trabajo de aprobación.

Aumente la eficiencia operativa con flujos de trabajo mejorados con IA que automatizan el reconocimiento y la ejecución de transacciones.

- Extracción automatizada de datos de más de 250 tipos de documentos financieros: EtonAI™ extrae datos de Avisos de Llamada de Capital, Avisos de Distribución, Declaraciones del Gestor, etc., creando flujos de trabajo para un procesamiento de transacciones sin fisuras y actualizaciones de valoración a precios de mercado en AtlasFive®.

- OCR contextual con inteligencia integrada

Nuestra OCR contextual pendiente de patente aprovecha el aprendizaje automático, EtonAI™, AtlasFive® CRM Knowledge Graph y Memorized Transactions para identificar automáticamente información crítica a partir de imágenes de documentos, sin necesidad de formación manual. - Etiquetado inteligente de transacciones y ejecución de pagos

Etiquete documentos a transacciones, entidades o cuentas e inicie pagos de capital directamente desde AtlasFive®, garantizando la automatización y trazabilidad de extremo a extremo dentro de su ecosistema financiero.

Planifique con precisión. AtlasFive® le permite prever y modelizar la liquidez con confianza.

- Modelización flexible de flujos de caja complejos: Modele flujos de caja recurrentes y puntuales adaptados a entidades específicas -como contribuciones trimestrales o desembolsos basados en eventos- para garantizar una planificación de la liquidez más precisa.

- Programación a nivel de entidad: Defina distintos calendarios de aportaciones y retiradas en las distintas entidades, lo que permite un control detallado de la posición de tesorería a corto y largo plazo.

- Informes exportables y personalizables: Genere informes de las transacciones previstas para integrarlos en informes personalizados o cuadros de mando analíticos, lo que le proporcionará total transparencia y control sobre los movimientos de efectivo previstos.

Informes de clientes: Información instantánea y personalizada

- Informes preelaborados: Acceda a más de 50 informes listos para usar sobre inversiones, tesorería, cumplimiento, etc., incluidos cuadros de mando diarios sobre rendimiento y contabilidad.

- Cuadros de mando personalizados: Utilice las API de generación de informes de AtlasFive® para crear sus propias soluciones de generación de informes a medida.

- Integración de Power BI: Explore y desglose fácilmente los datos de AtlasFive® con las herramientas de Power BI.

- Análisis del lenguaje natural: Aproveche EtonAI™ para analizar informes, generar perspectivas y traducirlos a varios idiomas.

Integración de datos

- Acceso a más de 1.500 bancos y depositarios directamente o a través de nuestros agregadores asociados.

- Procesamiento y agregación automáticos diarios de datos con un motor de reglas empresariales basado en IA.

- Los documentos procesados incluyen extractos de corretaje, extractos de gestor, facturas, avisos de llamada de capital, avisos de distribución, formularios fiscales, etc. También puede aprovechar nuestra tecnología Contextual OCR, pendiente de patente, para extraer datos de estos documentos.

- El equipo de servicios de Eton Solutions ayuda con el procesamiento de extractos y la extracción de datos del portal, incluida la migración de datos históricos.

Flujos de trabajo y auditoría

- Flujos de trabajo a medida: Cree rutas de tareas personalizadas que se adapten a las operaciones de su oficina, desde aprobaciones hasta transacciones, para garantizar que nada se pierda.

- Control de acceso inteligente: Conceda a las personas adecuadas acceso a los activos, informes y documentos correctos, protegiendo los datos confidenciales por diseño.

- Registro de auditoría completo: Cada clic, inicio de sesión, edición o descarga queda registrado, lo que le proporciona un registro completo y seguro para su tranquilidad.

Inteligencia artificial

EtonAI™ (antes EtonGPT™) aprovecha una potente combinación de las mejores tecnologías de IA de su clase para optimizar los procesos y mejorar la eficiencia de forma eficaz.

Digitalice y automatice el rastro del papel: EtonAI™ elimina la introducción manual de datos y el caos documental con la automatización inteligente de más de 250 tipos de documentos, lo que aporta velocidad, precisión y cumplimiento.

- Extracción instantánea de datos en todos los tipos de documentos: Desde facturas y llamadas de capital hasta K-1s, extractos bancarios/gerenciales y formularios KYC-EtonAI™ extrae información clave (fechas, importes, entidades, fondos, etc.) con precisión, utilizando OCR avanzado, Large Language Models (LLMs) y enriquecimiento contextual.

- Recopilación de documentos sin esfuerzo a través de EtonAIgency™. (Patente pendiente): Obtiene automáticamente documentos de portales web seguros, evitando captchas, MFA y muros de inicio de sesión, para que su equipo no tenga que hacerlo. Sin correos electrónicos, descargas ni inicios de sesión: los datos al alcance de la mano.

- Organizados, clasificados e indexados automáticamente: Todos los documentos se clasifican, etiquetan y archivan sin intervención humana. No es necesario renombrar archivos ni organizar carpetas: la inteligencia artificial se encarga de todo al instante.

- Comprende el contexto, no sólo el texto: Con OCR + LLMs + el Gráfico de Conocimiento ICL (Patente Pendiente), EtonAI™ entiende las relaciones entre cuentas, transacciones y entidades-mejorando la precisión de la extracción, reduciendo el retrabajo y mejorando la preparación para auditorías.

- Del documento al flujo de trabajo: en segundos: Active acciones posteriores directamente desde los documentos. Las facturas inician el pago. Las peticiones de capital mueven efectivo. Las valoraciones actualizan la valoración a precios de mercado. Todo ello mediante un motor de reglas de negocio personalizable.

Convierta el lenguaje natural en inteligencia de cartera: EtonAI™ Portal transforma el modo en que los equipos acceden a los datos privados, los consultan y actúan sobre ellos, sin necesidad de conocimientos técnicos.

- Front-End conversacional para datos privados: Haga preguntas como "Muéstreme los fondos más rentables por TIR" o "Resuma las peticiones de capital del último trimestre". EtonAI™ interpreta el lenguaje natural y ofrece respuestas directas desde su instancia privada de AtlasFive®.

- Búsqueda semántica de documentos: Nuestra base de datos vectorial agrupa, incrusta e indexa cientos de miles de documentos, lo que permite una búsqueda y recuperación semánticas rápidas, sin limitaciones de tamaño.

- Cargar, analizar, resumir: cualquier tipo de archivo: Cargue archivos PDF, imágenes, hojas de cálculo,. EtonAI™ lo convierte todo en texto estructurado y proporciona resúmenes, traducciones o extracciones en segundos.

- Investigación web integrada para conocer el mercado: Acceda a información en tiempo real y a datos financieros externos de forma segura, sin cambiar de pestaña ni utilizar herramientas externas. Ideal para el análisis de inversiones y la supervisión de gestores.

- Inteligencia multilingüe y multimodal: Traduzca informes, resuma documentos en idiomas extranjeros, redacte y narre archivos confidenciales o convierta infografías en datos procesables de forma automática.

- Visualizaciones dinámicas, generadas al instante: Visualice las tendencias de inversión, las estructuras de propiedad familiar o el rendimiento de la cartera en forma de gráficos de barras exportables, diagramas de dispersión, árboles genealógicos o informes de Excel, gracias a la visualización dinámica pendiente de patente de Eton.

- Power BI + AutoML para un análisis más profundo: Corte y divida los informes utilizando AutoML de Power BI, directamente a través del portal. Permita a los equipos no técnicos explorar, detectar patrones y obtener nuevas perspectivas sin codificar.

Confianza integrada en cada interacción: EtonAI™ se ha diseñado con la responsabilidad como eje central, garantizando que sus datos estén protegidos, que las decisiones sean explicables y que nunca se crucen los límites éticos.

- Infraestructura de IA segura con GPT privada: EtonAI™ se ejecuta en una instancia dedicada y privada, lo que significa que sus datos nunca se comparten, nunca se exponen y nunca se utilizan para entrenar modelos públicos. La información confidencial de sus clientes e inversiones permanece siempre dentro de su entorno AtlasFive®.

- ISO 42001 Certified for Artificial Intelligence Management System: Eton is proud to be one of the first wealth platforms globally to achieve ISO/IEC 42001 certification — the international standard for AI Management Systems. This achievement reflects our deep commitment to the ethical and responsible use of AI, helping us build and maintain trust with our clients and stakeholders. It ensures alignment with evolving regulatory and legal requirements, effective management of AI-related risks, and fosters innovation within a structured and accountable governance framework. At Eton, AI isn’t just smart — it’s secure, transparent, and trustworthy.

- IA explicable en la que puede confiar: EtonAI™ no solo ofrece respuestas, sino también razonamientos. Con los marcos de IA causal y explicable, cada predicción o sugerencia está respaldada por una lógica trazable, lo que proporciona a los usuarios y a los equipos de cumplimiento la visibilidad que necesitan para confiar en los conocimientos automatizados.

- Registro de avisos para la auditabilidad: Cada consulta, cada interacción con EtonAI™ queda registrada. Esto permite una trazabilidad y responsabilidad completas, de modo que siempre se sabe cómo, por qué y cuándo se tomó una decisión, lo que facilita las auditorías, las revisiones internas y los informes de cumplimiento.

- Sin alucinaciones, sólo hechos: Con una arquitectura híbrida que combina datos en tiempo real, documentos y registros estructurados, EtonAI™ minimiza el riesgo de respuestas alucinadas, garantizando que las decisiones se basen en la verdad verificada, no en conjeturas.

EtonAI™ reúne los bloques de construcción de IA más avanzados del mundo, adaptados específicamente a las necesidades de Family Offices, asesores de inversión e instituciones patrimoniales.

- Infraestructura de IA privada y nativa de la nube: La seguridad se une a la escalabilidad. EtonAI™ se ejecuta en una infraestructura dedicada, nativa de la nube, totalmente aislada, cifrada y sin servidores. Sus cargas de trabajo de IA se gestionan de forma segura, completamente separadas de cualquier tráfico de IA público.

- Grandes modelos lingüísticos híbridos (LLM): Eton combina LLM empresariales para ofrecer la combinación perfecta de inteligencia, rendimiento y rentabilidad. Esta estrategia multimodelo garantiza siempre resultados óptimos en tareas tan diversas como la extracción, el resumen o la investigación de mercado.

- Generación de Recuperación Aumentada (RAG): Vaya más allá de los modelos estáticos. EtonAI™ utiliza la arquitectura RAG para basar las respuestas de IA en sus datos y documentos reales de AtlasFive®. Esto garantiza respuestas precisas y en tiempo real basadas en lo que es cierto, no en lo que es probable.

- Base de datos vectorial: Con nuestra base de datos vectorial, los documentos se fragmentan, indexan y vectorizan, lo que permite la búsqueda semántica en todo el repositorio de documentos de AtlasFive®.

- Gráfico de conocimiento ICL (pendiente de patente): El grafo de conocimiento ICL de Eton descubre conexiones ocultas entre entidades, cuentas y transacciones, ofreciendo una precisión sin precedentes en la extracción de datos y la comprensión contextual. No es solo leer, es razonar.

- Reconocimiento óptico de caracteres (OCR) avanzado: EtonAI™ lo ve todo, desde llamadas de capital escaneadas hasta notas escritas a mano. Nuestro proceso de OCR, mejorado por el preprocesamiento basado en LLM, garantiza una extracción de datos de alta precisión, incluso de archivos no estructurados o de baja calidad. (Patente pendiente)

- Motor de reglas de negocio (BRE): Con más de 450 reglas específicas para oficinas familiares, nuestro BRE automatiza procesos como las actualizaciones a precios de mercado, el reconocimiento de posiciones, la validación de transacciones, etc., garantizando la integridad operativa a escala.

Ciberseguridad y privacidad

Eton Solutions proporcionó la mejor infraestructura de su clase para el sector de la gestión de patrimonios, incorporando inteligencia sobre amenazas basada en IA.

- Supervisión continua: El Centro de Operaciones de Seguridad (SOC) supervisa en tiempo real la infraestructura y el flujo de datos.

- Respuesta inmediata al incidente: Alerta y responde instantáneamente a anomalías, violaciones o intentos de intrusión.

- Despliegue aislado: Los clientes operan en instancias aisladas de un solo inquilino de Azure con claves de cifrado opcionales gestionadas por el cliente (BYOK).

- Cifrado de datos: Datos y documentos cifrados en reposo y en tránsito con protocolos AES-256 y TLS.

- Controles de acceso: El acceso basado en funciones y a nivel de entidad restringe los permisos de los usuarios, garantizando la separación operativa.

- Arquitectura resistente: Diseño nativo en la nube con copias de seguridad automatizadas, almacenamiento inmutable y conmutación por error geográficamente redundante.

- Certificaciones y conformidad: Certified for ISO 42001 (Artificial Intelligence), ISO 27001 (Information Security), ISO 27701 (Privacy), SOC 1 Type II & SOC 2 Type II (System and Organization Controls), and compliant with GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act).

- LLM privados: La IA funciona con grandes modelos lingüísticos privados sin compartir datos externos.

- Explainable AI Outputs: AI results are traceable, explainable, and scoped to user-level data access, consistent with ISO 42001 principles.

- Inicio de sesión único (SSO): Autenticación segura de usuarios que simplifica la gestión de accesos.

- Autenticación multifactor (AMF): Seguridad mejorada con capas de autenticación adicionales, alineadas con los estándares empresariales.

Nube nativa

AtlasFive® se basa en una arquitectura nativa en la nube y sin servidor que transforma la economía y la agilidad de las operaciones de gestión de patrimonio, ofreciendo resiliencia, velocidad y escalabilidad sin ninguna carga de infraestructura.

- Diseño sin servidor: La arquitectura nativa en la nube especialmente diseñada ofrece resistencia, velocidad y escalabilidad sin cargas de infraestructura.

- Sin mantenimiento: No hay servidores que mantener, no hay que actualizar el hardware y no es necesario ajustar la base de datos.

- Cambio de enfoque: Libera a los equipos del mantenimiento de sistemas de poco valor para que se concentren en el servicio al cliente y el crecimiento estratégico.

- Pago por uso: Pague sólo por lo que utilice, eliminando los costes de infraestructura ociosa y ajustando el gasto a la demanda real.

- Rendimiento escalable: Escala automáticamente la potencia de cálculo y el almacenamiento durante eventos financieros críticos, como los informes de fin de mes o la volatilidad del mercado.

- Sin tiempos de inactividad: El escalado se realiza sin intervención manual ni tiempo de inactividad del sistema.

- Actualizaciones invisibles: Las actualizaciones y los parches de seguridad continuos en la nube se ejecutan en segundo plano, garantizando el cumplimiento y la seguridad sin interrupciones informáticas.

- Infraestructuras resistentes: Los sistemas redundantes distribuidos geográficamente garantizan una disponibilidad ininterrumpida.

- Recuperación en caso de catástrofe: Diseñado para mantener el funcionamiento incluso durante cortes o catástrofes naturales.

Continuidad de las actividades

AtlasFive® garantiza que sus operaciones de gestión de patrimonios permanezcan ininterrumpidas. Gracias a las estrategias de copia de seguridad y recuperación ante desastres líderes del sector, los datos de su empresa estarán protegidos, siempre accesibles y siempre en línea.

AtlasFive® realiza copias de seguridad incrementales cada cinco minutos, combinadas con una copia de seguridad diaria completa. Esto garantiza que, incluso durante interrupciones inesperadas, sus datos más recientes permanezcan seguros, minimizando la interrupción de los servicios al cliente y la gestión de carteras.

AtlasFive® está alojado en varios centros de datos de todo el mundo, con replicación en caliente de toda su instancia. Esto significa que si una ubicación falla, su servidor de copia de seguridad está inmediatamente listo para tomar el relevo sin tiempo de inactividad, garantizando la continuidad del negocio y la confianza del cliente.

Con una infraestructura en la nube distribuida por todo el mundo, AtlasFive® garantiza que sus operaciones se mantengan en funcionamiento, independientemente de las dificultades geográficas, los desastres naturales o las ciberamenazas. No hay "tiempo de inactividad": su negocio de gestión patrimonial está siempre operativo.

Un proceso de implantación adaptado a sus necesidades

A diferencia de otras denominadas "plataformas integradas" del mercado, hemos creado AtlasFive® con el único propósito de resolver los retos a los que se enfrentan cada día las empresas de gestión de patrimonios.

Nuestros fundadores y directivos desarrollaron sus carreras en el sector de la gestión de patrimonios. La profunda experiencia de nuestro equipo en el sector significa que cada flujo de trabajo y estructura de datos se ajusta a las prácticas del mundo real, para que pueda migrar de sus sistemas existentes sin problemas a AtlasFive® y empezar a aportar valor desde el primer día.

Elegir AtlasFive® significa contar con un socio comprometido con su éxito, más allá de la puesta en marcha. Nuestro Centro de Servicio Global ofrece formación práctica, resolución de problemas y orientación proactiva para que su equipo domine la plataforma rápidamente, maximizando la productividad y minimizando las interrupciones. Con expertos dedicados disponibles las 24 horas del día, verá una adopción más rápida, un mayor retorno de la inversión y mejoras continuas adaptadas a sus necesidades cambiantes.

Mapeo de procesos gracias a la experiencia en el sector.

Hemos vivido sus problemas, hemos cartografiado las diversas necesidades de las family offices, hemos diseñado nuestro sistema en torno a estas necesidades gracias a nuestra experiencia en el sector y podemos gestionar estructuras de entidades y transacciones complejas.