Building, retaining, empowering, and optimizing teams is perhaps one of the biggest challenges facing any organization. Without good people who have the knowledge and tools to excel at their jobs, businesses cannot perform.

In our current labor environment, roiled by the turbulence of the “Great Resignation,” the issue has become even more pressing for many organizations. This includes family offices, where people-based services are at the core of the value delivered. In fact, a recent article in Forbes anticipates that 82% of family office professionals will change jobs in 2022. That means in a five-person office, as many as 4 people could leave—creating uncertainty for the family the office serves and threatening the stability and institutional memory within the office itself.

Prioritize Employee Retainment

A 2017 study by the Society for Human Resource Management (SHRM) suggests that it’s far more cost-effective to retain employees than to recruit new people. The study found that “employers will need to spend the equivalent of six to nine months of an employee’s salary to find and train their replacement.” Another study suggests replacing an employee costs approximately 21% of their salary. In family offices, where work is specialized, these most likely are underestimated.

A more recent study, completed in November of 2021, examines employers’ most significant human resources issues. The bar chart below shows data from a wide range of businesses across the United States. Still, it also encapsulates the dilemma facing family offices around staffing availability and its impact on office costs.

As the Forbes article points out, family offices face the unique challenge of “competing with both technology giants and Private Equity firms for the best investment professionals.” Some employees will seek the clear career path and news-worthy projects that come with employment at a global institution, while other professionals prefer the opportunities for creativity and independence available to family office staff.

Family offices need to prioritize the optimization of teams and resources to ensure business continuity and long-term success. The more intelligently they invest in their people and the technologies and training that empower them, the better their productivity, profitability, and service quality.

Many sources indicate that a family office typically spends between 60 and 70 percent of its total operating costs on staff compensation and benefits. In other words, creating a working environment in which high-quality employees thrive and enjoy their work is essential to the success of any family office. It’s something family offices simply must get right.

The Relationship between Human Capital & Smart Technology

A critical ingredient for getting it correct is adopting technology solutions that empower people, and organizations, to be more successful and remove stress and costly and morale-deflating errors from the way they work. Technology can automate mundane and stress-producing tasks and allow highly trained employees to perform more gratifying and high-value work. It can also reduce the need to search for and hire additional employees as workloads and complexity grow. In addition, it can ensure that when employees do leave, they don’t take all their knowledge and capabilities with them.

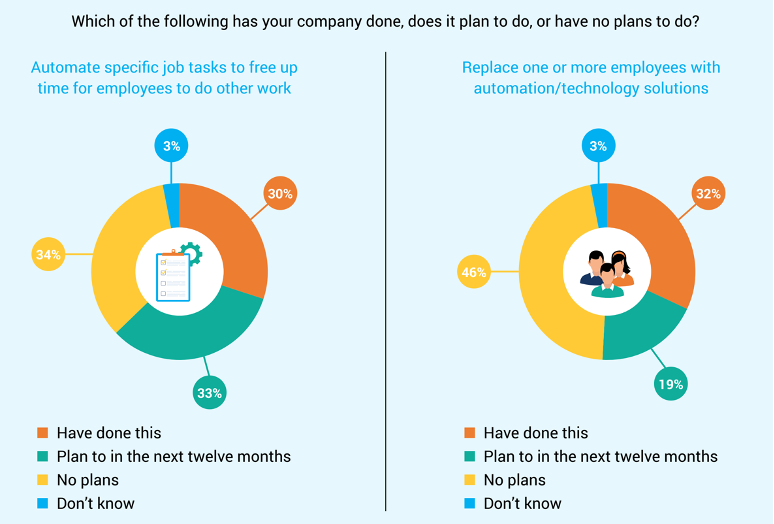

Based on the same survey mentioned previously, the chart below demonstrates that businesses of all kinds are looking to technology to address the human capital dilemma.

Without a doubt, the best technology solutions for family offices and other businesses work in close combination with people. They empower people, not supersede them. The Harvard Business Review recently published an article, “Using Technology to Make Work More Human,” that looks at the future of people and technology working together. It has some great insights. (also see our blog on Rehumanizing the Family Office, where we go into great detail on this topic).

Here’s an excerpt:

“…we define “smart tech” as the AI and other advanced digital technologies that automate work by taking over tasks that only people could do previously. Smart tech makes decisions instead of and for people. While some feel that the interests of workers are at odds with smart tech — that humans and machines are in direct competition — we believe that this is a false dichotomy that’s uninformed, unimaginative, and just plain wrong. Smart tech and humans are not competing with one another; they are complimentary, but only when the tech is used well.”

The Family Office Solution: Purpose-Built Technology for a Successful, Fulfilling Future

Technology as an enabler to solve staffing problems requires an approach that complements the optimized skill set of humans in the family office. The technology should be focused on automating what can be automated, with people there for problem-solving and decision making. Automation in a family office requires a single source of data and a technology that facilitates seamless, transparent business processes and workflows—driven by embedded best-practice human knowledge.

The HBR points to an approach to achieving success:

“Identify key pain points to determine the right use cases. These should focus on areas where smart tech can take over rote tasks that can streamline unmanageable workloads and reduce worker stress…

Choose the right smart tech for the job…

Create a virtuous cycle of testing, learning, and improving. Step carefully and slowly, because it can be difficult to undo the harms of automation once smart tech is in place.”

Family offices need a purpose-built technology platform that empowers staff to meet the specific needs of Ultra-High-Net-Worth (UHNW) clients—a system that reduces inefficiencies and allows staff to concentrate on things only humans can do. The right purpose-built system should understand and accommodate the unique structural complexities and dependencies of UHNW families; simplify, streamline, and verify both data entry and analysis across every entity and family stakeholder; and improve the quality of communications, reporting, and decision making.

The technology platform used should be one that understands the business, built by a family office, for a family office: A platform that enables the office to have a single source of data, and not the typical data silos, especially apparent in spreadsheets. It must have best practice business processes and workflows at its core in order, as HBR says, to have the correct use cases that can take over routine tasks and can also be the knowledge base for the “virtuous cycle of testing, learning, and improving.”

The right technology can solve the staffing dilemma we mentioned previously, but it can also position a family office to succeed in the future. As family offices evolve and shoulder more responsibilities for their clients, they must learn to scale effectively to be productive. However, the solution is more complex than simply implementing more technological processes into the office’s workflow. Instead, the family office must continue cultivating a relationship of trust with the clients, which requires a “people first” mindset.

Choosing the right technology for a family office enables its people to nurture client relationships and focus on long-term planning that aligns with the family’s goals—all while having confidence that the data is useful: accurate, relevant, and timely. The family office of the future will never look like a surreal science fiction room full of robots or computers emotionlessly processing data; the heart of the family office will always be the trustworthy staff. But when that staff is supported by the right technology and workflows are implemented so that computers do the routine manual tasks that repeatedly consume staff time – when we let technology do what it’s good at – we envision a family office that puts people’s skills first and enables personnel to achieve more than previously possible. Let people do what they’re good at and be amazed by what your office can achieve.