Bill-pay in a family office—what does it look like? The process starts when a product or service is purchased, and the office receives a vendor invoice for payment. That invoice is recorded, validated, approved for payment, and then paid. The process is time-consuming and error-prone for many family offices, involving manual, paper-intensive workflows, multiple point systems, and spreadsheets.

Now imagine bill-pay and transaction processing as a seamless process not dependent on manual work, pieces of paper, manila folders, spreadsheets, or siloed software. Imagine a complete, end-to-end workflow with transparency and auditability at every level all the way through to the movement of money using an integrated payment gateway. This is bill-pay reimagined.

What does a seamless workflow mean within the family office? It means that all data, like that coming from an invoice, are processed end-to-end through a single integrated platform. An invoice is automatically uploaded into the platform, the document is ‘read’, and details like vendor, amount, date, entity name, etc., automatically populate a pre-formed template. That template has the built-in business “knowledge” around the relationships of all participants needed to record the data properly. It automates time-consuming tasks that are often associated with bill-pay, such as allocating a transaction across multiple legal entities at specific percentages.

The template creates a workflow where humans review and approve the transaction through to payment. This is not the typical review where paper is passed around. When bill-pay is reimagined, like in our platform AtlasFive, the approval steps are embedded in the system and assigned by role and responsibility. If a family member wishes to be involved in any approval workflow, they can participate using the system’s unique client portal or mobile app.

After final approval, a check can be cut, a payment can be added to an ACH payment batch, or a wire process initiated, and all of this is done within AtlasFive without “switching” to a bank portal.

Soon, artificial intelligence (AI) elements will replace the mundane elements of the bill-pay processes, like documents being automatically read and all the data elements for processing and posting completed by AI. The office staff can then do critical work around analysis, oversight, approvals, etc.

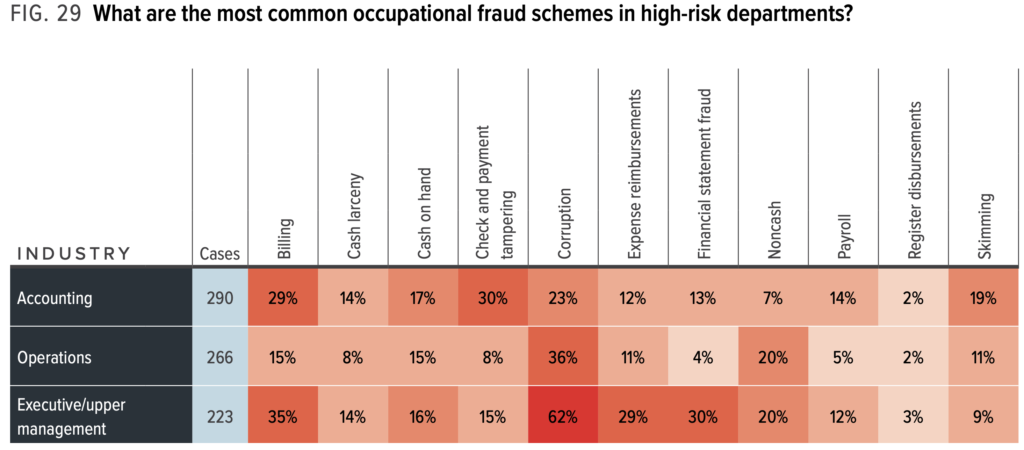

The implications go well beyond efficiency. Fraud occurs in some family offices. The problem most frequently occurs around the movement of money, such as bill payment, because there is too little transparency in the whole process. As the table below shows, fraud can occur across different functions and processes within organizations.

Some figures from 2019 (Assoc. Certified Fraud Examiners):

The key to combatting fraud is a seamless process with real controls, transparency, and risk management. Below are the critical elements needed to achieve this:

- Segregation of duties (SYSTEM enforced roles and responsibilities)

- Single point of data entry with maker/checker process for data integrity

- Automated bank/custody reconciliations with audited exception management

- Daily reconciliations

- Automation of transaction-based GL journals (NOT manual)

- Operationally enforced payments limit and authorizations

- Maker/checker workflow for manual GL journals

- Automated reporting (NO spreadsheets!)

- On-demand audit trail

The old “we have always done it this way” approach, where manual work and disparate software applications are used as systems of record (with a series of spreadsheets as the consolidator and report creator), will never provide the necessary controls.

AtlasFive represents a paradigm shift across virtually all of the work done within a family office. It provides the basis for a lean principles approach with seamless, end-to-end process and workflow for bill-pay and every other task within the office.

The lean process approach and ERP (Enterprise Resource Planning) technology have been used to conquer critical business challenges in many other businesses, providing a highly productive and transparent environment with seamlessly integrated data, processes, workflow, and people. This has allowed businesses to reimagine how they operate. The result is the integration of embedded best practice processes and business rules, together with access to a single source of data. It has dramatically improved visibility and control at multiple levels, including the accounts payable processes around bill-pay.

A significant benefit of lean processes and ERP systems is to eliminate mundane tasks, such as bill-pay, and allow organizations to focus on high-value work like analysis and meeting the goals of business agility and innovation.

Is there an ERP system designed specifically for a family office? Yes! Check out AtlasFive here.