The Alpha in Wealth Intelligence

The Intelligent Administrative Wealth Platform for UHNWI. Control your wealth confidently. Simplify complexity. Make smarter decisions.

The Power of EtonAlpha™

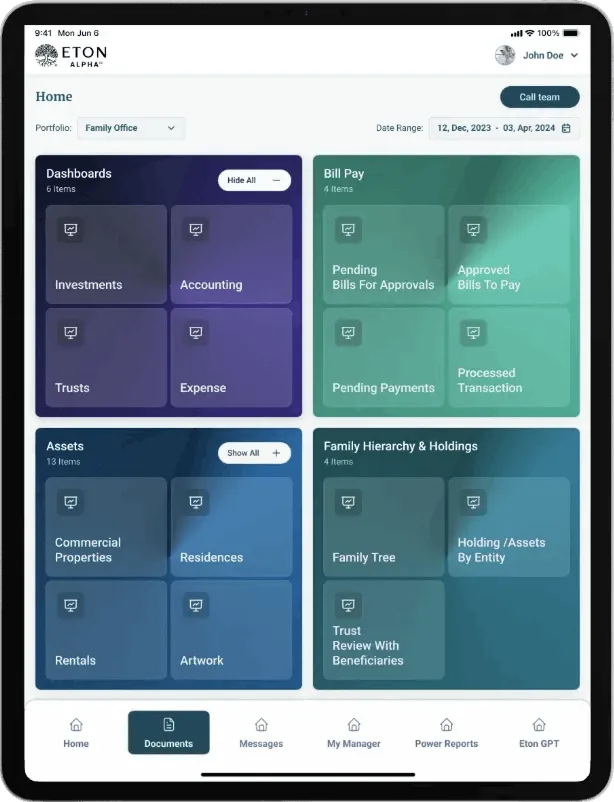

EtonAlpha™ is an intelligent, AI-powered digital Administrative Wealth Platform designed for ultra-high-net-worth individuals who want seamless control over their entire financial universe. From investments and private assets to legal documents and philanthropic initiatives, EtonAlpha™ centralises everything — accessible on your terms, anywhere, anytime.

Download EtonAlpha™ eBrochure

Download the full EtonAlpha™ brochure and see how intelligent wealth management can transform the way you live, plan, and make decisions.

What You Get with EtonAlpha™

Live Fully, Securely, with Confidence EtonAlpha™ allows you to focus on living your best life while leaving the complexity of wealth management to a smart, secure, and comprehensive platform. Tailored for your unique assets and family legacy, it’s the digital control tower for every aspect of your wealth.

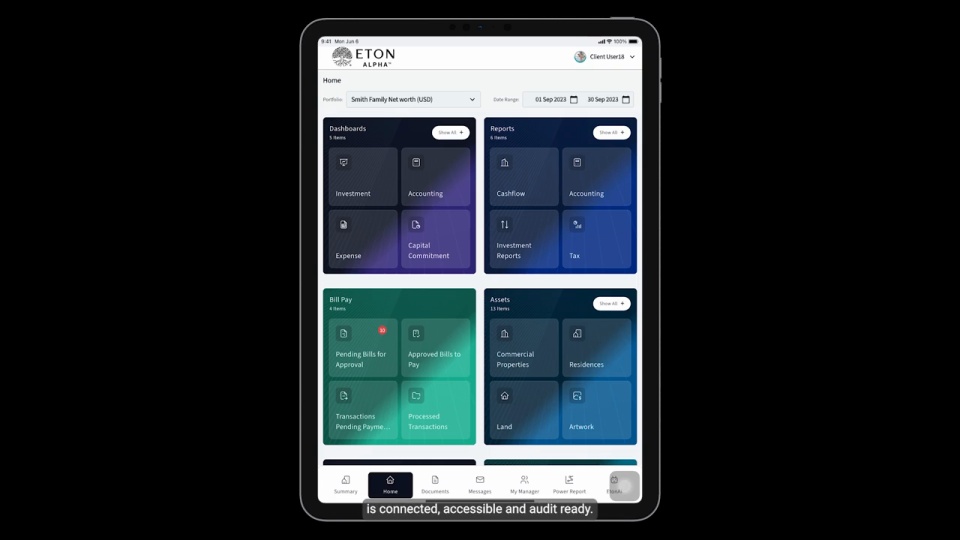

Real-Time, Unified Wealth Overview

Instantly view your investments, private assets, properties, and valuables all in one dashboard, updated continuously.

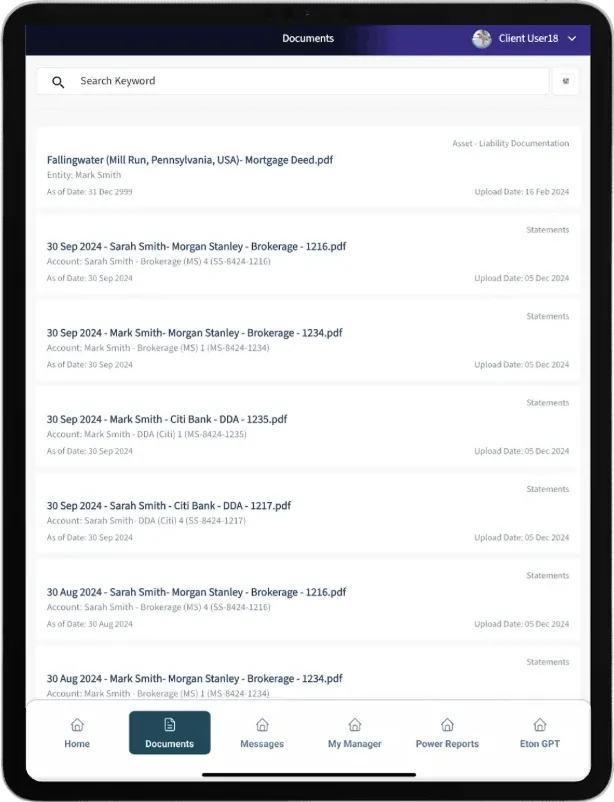

Secure Document Vault

Safely store wills, deeds, trust documents, and key papers—encrypted and accessible only to you or authorised parties.

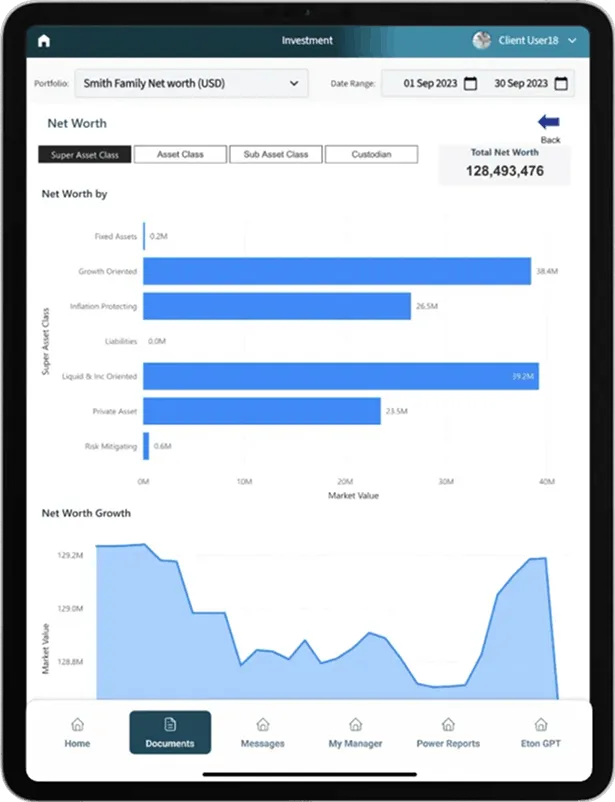

Investment & Net Worth Intelligence

Gain a complete, real-time view of your total net worth across entities, custodians, and asset classes — all within a single, integrated platform.

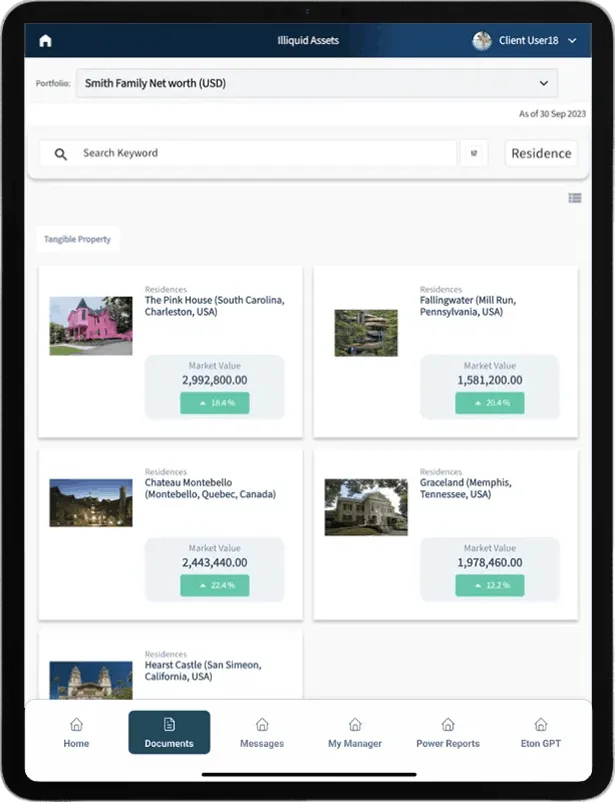

Ultimate Asset Control

Track the valuation and status of jewelry, art, cars, wine collections, real estate, and private investments in real time.

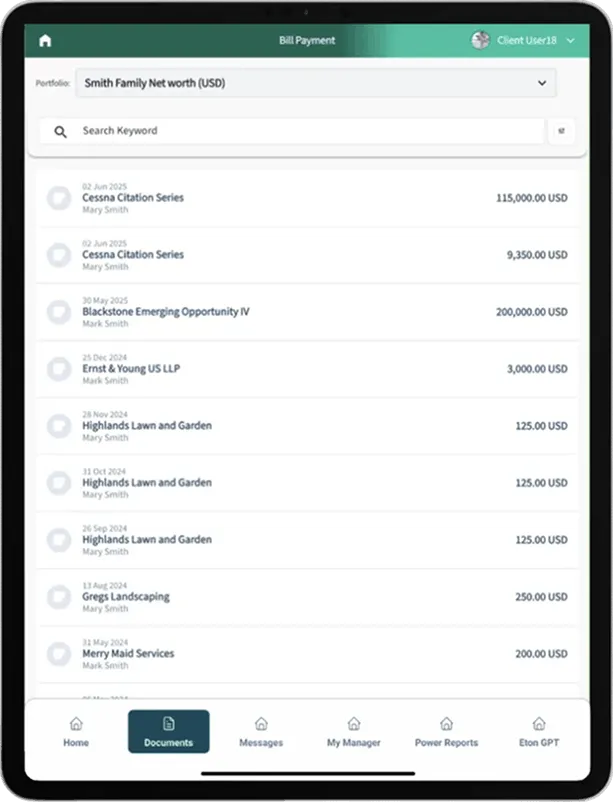

Simplified Cash Flow & Bill Management

Automate invoice collection, approval workflows, and payments — always stay ahead with an up-to-date view of your cash position.

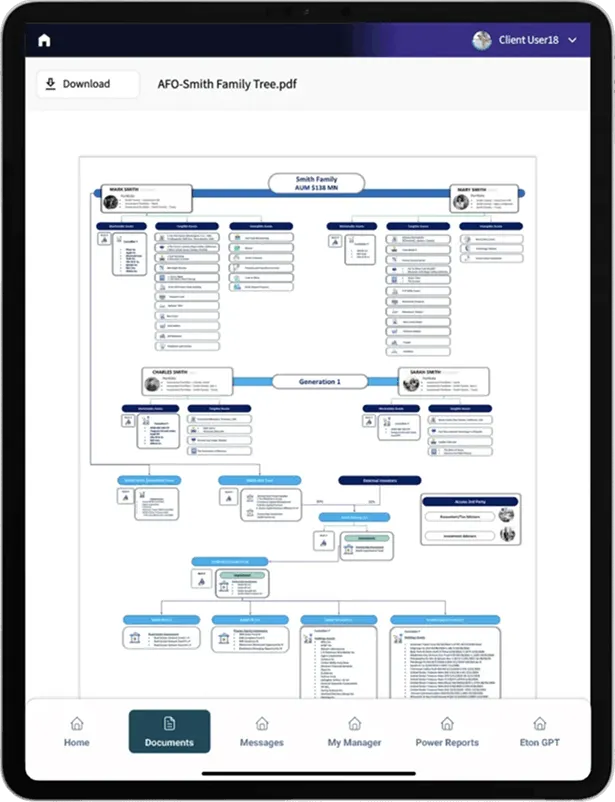

Family Hierarchy & Entity Oversight

Gain complete transparency across your family structure with integrated custodian reporting and clearly defined ownership entities.

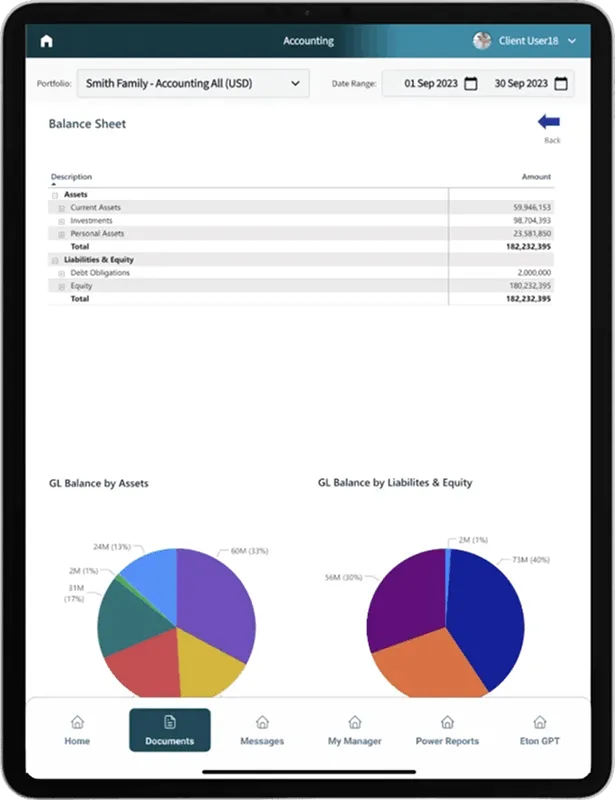

Integrated Accounting & Administration

Experience complete operational transparency through integrated, real-time accounting and intelligent expense management. Produce detailed reports, structure spending data, and maintain clear oversight of costs across every family member and entity.

Data Reliability & Security

Pull data from banks, custodians, and private sources automatically—delivering accurate, real-time insights while protecting your privacy.

See How EtonAlpha™ Works?

Designed for ultra-high-net-worth individuals with assets starting from $25 million, EtonAlpha™ offers a comprehensive, integrated solution that delivers the same powerful capabilities as traditional large family offices - at a fraction of the cost.

EtonAlpha™ provides a virtual, secure, and user-friendly wealth management experience - essentially putting a full family office in the palm of your hand.

Why Choose EtonAlpha™ ?

Focus Area

- Single Source of Truth

- Access Control. Anytime. Anywhere.

- Bill Pay & Document Management

- Get Tax Ready

- Centralised & Protected Data

Key Challenges

- Overwhelmed managing complex assets and cash flows

- Managing trust documents & charitable activities in chaos

- Missing bills, scattered legal documents

- Spending weeks gathering statements, difficulty tracking valuables

- Inconsistent data, delays in reporting

EtonAlpha™ Solution

- Simplified dashboards with instant insights and automation for decision-making

- Secure vaults accessible anytime, anywhere, with clear management tools

- Automated bill pay, document management, and flow approvals

- Centralized, organized, and advisor-ready reports; real-time valuations

- Reliable daily data pulls from all sources—confident, unified reporting

Explore the Future of Wealth Management with EtonAlpha™