The Integrated Fund Accounting Software & Data Platform

Revolutionize your fund accounting and administration with our comprehensive, secure, and intuitive software. Eton Solutions provides the integrated platform you need to manage your fund operations effortlessly, ensuring accuracy and compliance.

Built for Funds, Optimized for Accuracy — Leading Fund Accounting & Data Management

Eton Solutions delivers a cutting-edge platform tailored to your fund accounting software needs, offering precise financial reporting and robust data management. Our innovative platform centralizes investment, accounting, and tax data, providing a real-time, holistic view of all fund assets while ensuring 100% data privacy and security.

Why Choose Our Fund Accounting Software?

Complete Data & Reporting Integration

Unify all your fund data from custodians, banks, and investments into a single, seamless system. Multi-currency support, tax compliance, and automated reporting improve fund accounting efficiency.

Supercharged Decision-Making with WealthAI

Leverage advanced intelligent document processing, sophisticated investment analysis, and deeper insights with 400+ use cases to enhance your fund's strategic planning and performance.

Secure & Private Data Management

Certified with industry-leading standards including ISO 27001 (Security), ISO 27701 (Privacy), ISO 42001 (Artificial Intelligence), SOC 1 and SOC 2, and our unique Bring Your Own Key (BYOK) encryption feature guarantees complete control over your fund data.

Global Reach, Local Support

Empowering you to operate seamlessly across 54+ countries while staying compliant with local data regulations, multi-currency management, and local bank integration for global fund operations.

Explore Key Features of Our Fund Accounting Software

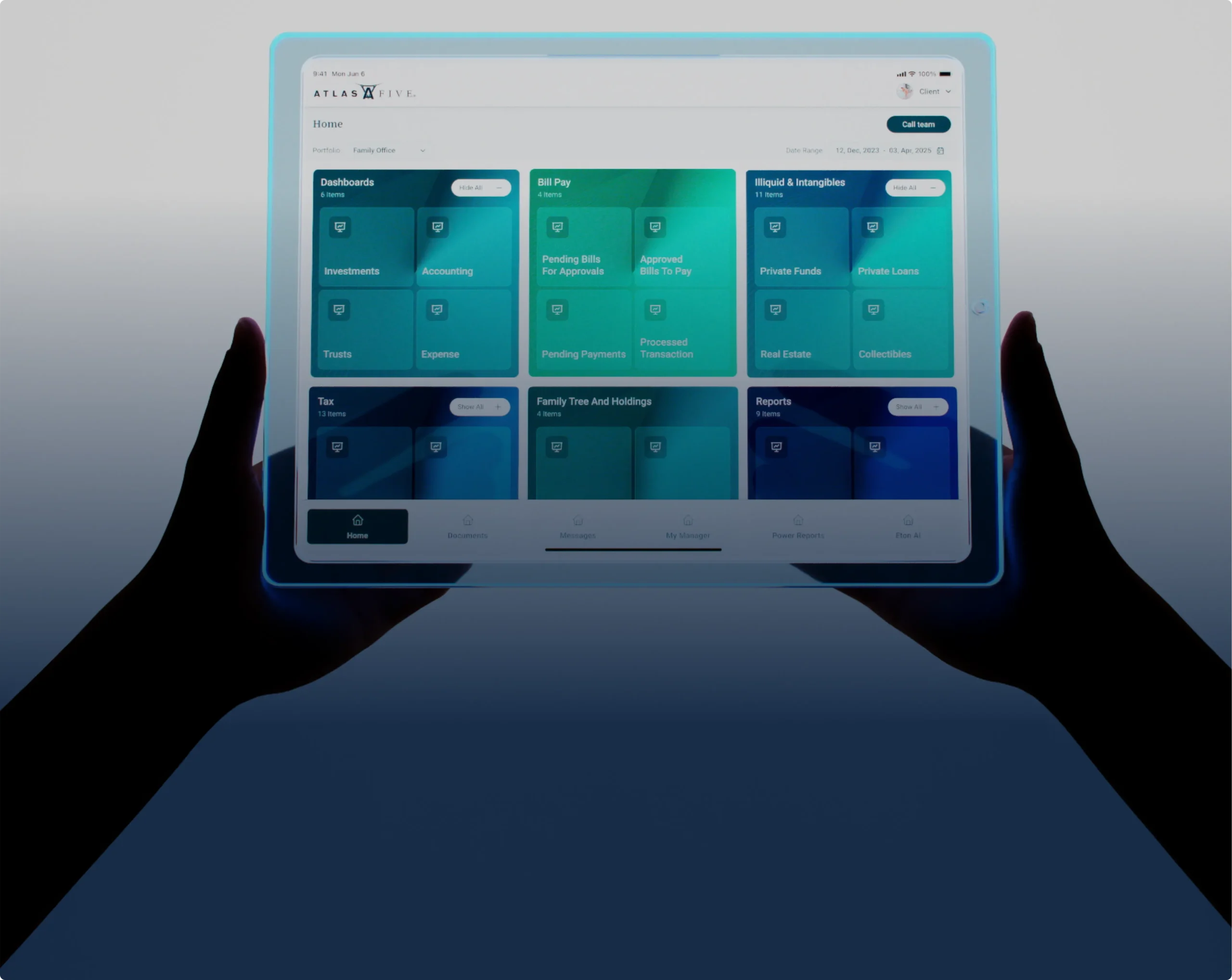

Unified Asset & Wealth View

Visualize your entire fund structure, assets, liabilities, and holdings in an interactive, real-time dashboard for instant insights into fund performance.

Data Aggregation & Reporting Software

Real-time feeds from custodians, banks, and alternative investments provide accurate data, enabling robust fund accounting reporting that supports compliance and strategic analytics.

Investment & Asset Management Tools

Seamlessly monitor and manage fund investments across various asset classes. Automate routine tasks with AI-powered features to optimize fund operations.

Security & Data Privacy

Industry-leading encryption, private cloud architecture, and strict access controls uphold the data privacy of your fund, aligning with the highest security standards for financial data.

Eton Solutions — The Future of Fund Accounting & Reporting

Empower your fund operations with intelligent automation, real-time financial reporting, and secure data management — designed for precise fund accounting, performance reporting, and complex wealth management.

+$ 0 Trillion

Assets Managed on Platform

+ 0

Entities

+ 0

Liquid and Illiquid Assets Aggregated on Platform

+ 0

Families on Platform

+ 0 Million

Transactions Processed Annually

+$ 0 Billion

AUM Across 2,000+ Funds on Platform

What Our Clients Say